What is the Daily Periodic Rate Calculator?

The Daily Periodic Rate Calculator is a tool designed to help users understand and calculate the daily interest rate charged on a loan or credit account. By inputting the annual interest rate and the number of days in a billing cycle, the calculator provides the daily interest rate, allowing individuals to estimate their daily interest charges accurately.

Benefits of the Daily Periodic Rate Calculator include:

- Accurate Interest Calculation: It enables users to calculate the exact amount of interest accrued on a daily basis, providing a clearer picture of the overall interest cost over time.

- Financial Planning: By knowing the daily interest rate, individuals can better plan their finances and budget for interest payments, helping them stay on track with their repayment goals.

- Comparison Tool: Users can compare different loan or credit options by calculating and comparing their respective daily interest rates, allowing them to choose the most cost-effective option.

- Educational Tool: The calculator serves as an educational tool, helping users understand how interest rates impact their finances and encouraging financial literacy and responsibility.

- Decision Making: Armed with accurate interest rate information, individuals can make informed decisions about borrowing, lending, or managing their debt, leading to improved financial decision-making overall.

Overall, the Daily Periodic Rate Calculator empowers users to manage their finances more effectively by providing essential information about daily interest charges and aiding in financial decision-making.

How to Use Our Daily Periodic Rate Calculator?

Follow these simple steps to understand your daily interest charges:

Step 1: Enter Your Credit Card Balance

In the designated field, enter the current outstanding balance on your credit card. This represents the amount you currently owe.

Step 2: Input Your Interest Rate

Locate the field labeled “Interest Rate.” Here, enter the Annual Percentage Rate (APR) associated with your credit card. This is the yearly interest rate you are charged on your outstanding balance.

Step 3: Click “Calculate”

Once you’ve entered both values, click the “Calculate” button. The calculator will work its magic and display the results.

Understanding Your Results:

- Daily Periodic Rate (DPR): This section will reveal your calculated Daily Periodic Rate. Remember, the DPR is the interest charged on your balance for a single day.

- Daily Interest Amount: Here, you’ll see the estimated amount of interest you accrue on your daily balance. This value is derived by multiplying your DPR by your credit card balance.

The world of finance can be riddled with complex terms, and the Daily Periodic Rate (DPR) is no exception. This seemingly obscure concept significantly impacts your loan costs, so understanding it empowers you to make informed financial decisions. Let’s delve into the intricacies of DPR, exploring its role, influencing factors, and limitations, along with some frequently asked questions.

What is the Daily Periodic Rate (DPR)?

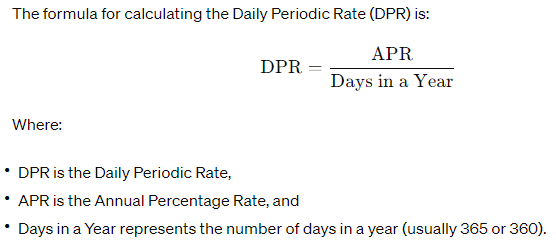

The DPR represents the interest charged on your loan balance for a single day. It’s a crucial component used to calculate your monthly interest payments and ultimately determines the total cost of your loan. Here’s the simple formula:

Why is the Daily Periodic Rate Important?

The DPR plays a vital role in understanding how interest accumulates on your loan over time. It allows you to:

- Calculate Monthly Interest: By multiplying your DPR by your daily loan balance, you can estimate the daily interest charged.

- Compare Loan Options: Knowing the DPR of different loan offers allows you to compare the true cost of borrowing and make informed financial decisions.

- Plan Your Budget: By understanding your monthly interest payments, you can effectively plan your finances and allocate funds accordingly.

Factors Affecting the Daily Periodic Rate

Several factors influence your DPR:

- Annual Percentage Rate (APR): This is the yearly interest rate you pay on your loan, and it directly affects your DPR. A higher APR translates to a higher DPR and consequently, more interest charged daily.

- Loan Term: Though not directly impacting the DPR calculation, the loan term (length of time to repay the loan) influences the total number of days interest accrues.

Limitations of Daily Periodic Rate

- Estimates vs. Reality: The DPR provides an estimate based on a 365 or 366-day year. Some lenders might use a different method for calculating daily interest, leading to slight variations.

- Focus on Daily Charges: The DPR sheds light on daily interest, but it doesn’t encompass other loan fees. Always review the loan agreement for a complete picture of the costs involved.

Embrace Financial Literacy

By understanding the Daily Periodic Rate and its impact on your loan costs, you gain valuable knowledge to navigate the world of finance with confidence. Utilize our Daily Periodic Rate Calculator and the information provided here to make informed financial decisions and achieve your financial goals.

FAQs

1. Is a lower DPR always better?

Absolutely! A lower DPR translates to less daily interest charged and ultimately a lower total loan cost.

2. How can I lower my Daily Periodic Rate?

Negotiating a lower APR with your lender is the most effective way to reduce your DPR.

3. Can I calculate the DPR myself?

Yes, you can use the formula mentioned earlier (DPR = APR / Number of Days in a Year). However, our Daily Periodic Rate Calculator offers a convenient and user-friendly way to get the same result.

4. Does the DPR apply to all loans?

The concept of DPR is most commonly associated with credit cards and personal loans. Mortgages typically use a different interest calculation method.

5. What if I don’t understand my loan agreement?

Don’t hesitate to seek clarification from your lender. Understanding the terms and conditions, including the DPR, is crucial before signing any loan agreement.

Related Calculators

I just happen to find this tool, and have used it about 20 times in just a few days, it is very useful …thanks for letting us use it free!!

BT

How do you convert the Daily Periodic Rate to the APR?

Phil, if you have not got your answer, you can take the DPR%, times 365 = APR% really close.

My credit card company charges an APR of 7.99%, but the daily periodic rate they are charging me is 0.02218%. According to your calculator I am being charged an APR of 8.09%, not 7.99%. Are they cheating me?

My credit card charges me and APR 29.99%, the DPR is 0.08217%, my average daily principal balance is $1,913.62 so this month my finance charge was $157.42; Is that correct?

I know how they got it 1913.62 x 0.08217 = 157.42 but shoudn’t it be 1913.62 x (0.08217/100) x 30 = 47.17.

You have to understand that credit Interest accrues daily. So for example if your Interest rate is 9.99 you daily periodic rate is 0.0274% or $3.12. So if you take $3.12 x 30, for 30 days in a month your monthly Interest is $93.60 a.

If I make a monthly payment at the begining part of the billing cycle instead of by the due date are there any interest savings on a card with a daily periodic rate. Thank you. Steve.

Or you can use the ‘Effect’ function in Excel as: =Effect(rate,365)

Jon, the banks use a calendar of 360 days to calculate DPR.

APR – is the rate for the year not accounting for compounding interest

DPR – is the rate for the day

Effective interest rate – is the rate that accounts for the compounding effects of interest

If you incl. interest applied on interest you will be paying more than the APR.

Most credit cards calculate the rate daily and compound monthly because your closing balance at the end of each day could be different as you make additional purchases or payments.

Jose you are paying far too much interest to carry a balance on your credit card. I suggest you switch or call the company to see what other options they have available to you.

hzy bitch

all comment are reviewed for content

My bank is offering 0% daily periodic rate on as much as a $10k loan until 11/2018.

Does this mean no interest charged until 11/2018?