Take control of your financial health by utilizing our Debt To Asset Calculator. It’s a simple tool designed to help you assess and manage your financial stability effortlessly.

[DEBT-TO-ASSET-CALCULATOR]

Managing debts and assets can be like walking a tightrope for many individuals and businesses alike. Knowing just how much debt is healthy concerning your assets is crucial for financial stability.

Understanding the Debt-To-Asset Ratio

Grasping the debt-to-asset ratio is crucial as it unveils the proportion of a company’s assets that are financed by debt, offering insights into its financial leverage and stability.

This figure not only reflects a business’s ability to cover its obligations but also influences how it’s perceived by investors and lenders.

Definition

The debt-to-asset ratio measures a company’s total debt against its total assets. This figure tells us how much the company is financed by debt compared to what it owns. If a business has more debts than assets, this ratio will be high, signaling possible financial problems or higher risk.

On the other hand, if the assets outnumber the debts, then the ratio is low and suggests a healthier financial status.

Knowing this number helps investors and lenders understand how risky it might be to give money to or invest in a business. It also shows if a company relies too much on borrowing rather than using its resources for growth or operations.

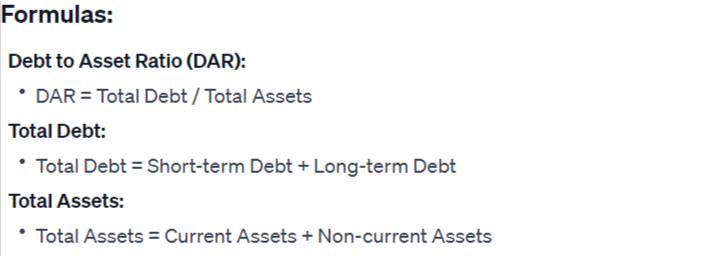

Formulas

Related Table:

| Category | Amount (£) |

|---|---|

| Short-term Debt | £10,000 |

| Long-term Debt | £50,000 |

| Current Assets | £80,000 |

| Non-current Assets | £120,000 |

Why It Matters

Knowing the debt-to-asset ratio helps people judge a company’s health. Investors look at this number to decide if they should put in their money. It tells them how much of what the company owns is paid for with borrowed money.

Creditors use it too. They need to know if giving more loans is safe. If a company has too much debt, it might not be able to pay it back.

Company bosses also rely on this ratio. They check where they can cut down on borrowing or find better ways to handle debts. High financial risk signals trouble for a business, especially during tough times.

This ratio is like a health check-up for finances, and everyone involved with the business pays attention to it.

Now let’s learn how you calculate this important number.

How To Calculate

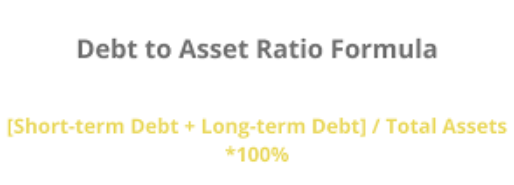

Understanding the importance of the debt-to-asset ratio helps you see why calculating it is crucial. To find this ratio, divide your total debt by your total assets. Total debt includes both short-term and long-term obligations on your balance sheet.

This means adding up all debts like loans, credit card balances, and any other money owed. Total assets are everything owned that has value – property, equipment, inventory, and cash in hand.

Simple division gives you a percentage showing how much of what you own is financed through borrowing. Now you can Plan your financial future with our handy ANC Calculator, helping you determine accumulated net capital.

The Formula For Calculating The Debt-to-Asset Ratio

To calculate the debt-to-asset ratio, divide total debt by total assets. Consider everything you owe as total debt; this includes what you must pay soon (short-term) and debts to be paid in the future (long-term).

Look at all you own for total assets. This covers stuff you can touch like buildings (tangible) and things like patents (intangible). The result shows how much of your assets are funded by borrowing.

You will write this number down as a percentage. It helps people see quickly if there is more borrowed money than owned items. High percentages can warn of risks since it means using lots of loans compared to what one owns.

However low percentages usually make investors happy because they suggest less reliance on borrowed funds.

Using The Debt-To-Asset Ratio Calculator

Navigating through a debt-to-asset ratio calculator can simplify the complex process of financial analysis, enabling both individuals and businesses to gain quick insights into their financial health—let’s dive in to see how it works in practice.

Step-by-Step Guide

- Gather all the numbers you need from your balance sheets. Start with finding your long-term debt, which includes any loans or mortgages that will take more than a year to pay off.

- Next, add up any short-term debt like credit cards or accounts payable—these are debts you need to pay within the next 12 months.

- Combine all your debts to get your total debt amount. Don’t forget anything that you owe!

- Then calculate the value of everything you own—that’s your total assets. This includes cash, property, and inventory.

- Go to the debt-to-asset ratio calculator on your computer or phone. Enter your total debt number in the space provided for it. Do the same for your total assets in its designated area.

- Look for the ‘calculate’ button and click it without delay.

- Check out the result that pops up on the screen—that’s your current debt-to-asset ratio! Now use this information to make smart decisions about borrowing and spending to keep a healthy financial status for yourself or your business.

Result

You’ll see your company’s debt-to-asset ratio after you hit the calculate button. This number tells you how much debt you have compared to what you own. A low ratio means a stronger financial position and less risk of not being able to pay back debts.

If it’s high, that could mean trouble if money gets tight. It helps business owners decide on things like taking out loans or planning for tough times ahead.

This ratio also guides investors who want to understand a company’s stability before they invest. They use it to weigh the risk against possible returns. For example, a firm with too much debt might not be the best choice for putting in money, as their chances of running into financial issues are higher.

Interpretation and Analysis

Understanding the result from a debt-to-asset ratio calculator is key to making smart choices. A business gets to know how much it owes compared to what it owns. Low ratios show that a company isn’t using a lot of debt which means less risk.

High ratios tell us the company has more debt and could face trouble if there’s an economic downturn.

A good grasp of this ratio helps companies decide when to borrow more or pay off debts. Investors and creditors look at this number to see if a business can handle its financial obligations.

Each industry has its normal range, so businesses must also consider their specific market standards. Simplify your tax calculations with our GST Calculator, computing Goods and Services Tax effortlessly.

Example of Calculating Debt-to-Asset Ratio

Let’s say a company has $500,000 in short-term debt and $1,000,000 in long-term debt. This makes its total debt $1,500,000. Now imagine the same company owns assets totaling $3,000,000.

To find the debt-to-asset ratio, divide the total debt by the total assets.

The calculation would be $1,500,000 (total debt) divided by $3,000,000 (total assets). The result is 0.5 or 50%. This means half of the company’s assets are financed through debt. A business with a 50% ratio might need to look at its indebtedness and consider strategies for managing it better.

| Category | Amount ($) |

|---|---|

| Short-term Debt | $500,000 |

| Long-term Debt | $1,000,000 |

| Total Debt | $1,500,000 |

| Total Assets | $3,000,000 |

| Debt to Asset Ratio | 50% |

This table breaks down the company’s short-term debt, long-term debt, and total debt. It also shows the total assets and calculates the debt-asset ratio, which is 50%.

They could improve their financial health by reducing liabilities or increasing assets over time.

Improving Your Debt-to-Asset Ratio

Managing your debt-to-asset ratio is crucial for maintaining financial health and solidity. We’ll delve into strategies that can help lower this key metric, enhancing a company’s attractiveness to investors and lenders alike.

Tips and Strategies

Pay off your high-interest debts first. This will save you money in the long run. You can also think about rolling multiple debts into one. This might give you a lower interest rate and make payments easier to handle.

Make a budget to help control your spending and prevent new debt from piling up.

Find ways to bring in more money, too. Extra income can go straight toward paying down what you owe faster. As debts shrink and assets grow, your debt-to-asset ratio will improve over time.

Remember, keeping this number low shows others that your finances are strong and healthy.

Importance for Businesses

A strong debt-to-asset ratio boosts a company’s credit rating. It shows banks and insurance companies that the business handles debt well. This can lead to lower interest rates on loans, saving money for the company.

Businesses with better ratios often find it easier to get extra funding like a line of credit.

Keeping a low ratio is key during tough times. It makes sure the company has enough assets to cover its debts if things go wrong. Investors look for firms with healthy ratios before they put their money in.

A good ratio also means less chance of defaulting on loans, which keeps investors happy and confident in the business’s future.

Calculators like the Debt to Asset Ratio tool make crunching numbers easy. They show you how much of a company’s stuff is paid for with borrowed money. Want to see if a business owes too much? Just type in two numbers and press “calculate.” Smart decisions come from understanding these ratios, whether you’re investing or running a business.

So go ahead, use this tool, and steer your finances wisely! Now you can evaluate your investment performance using our Return on Asset Calculator, measuring profitability relative to assets.

Here are some example tables related to a Debt to Asset Ratio calculator:

Table 1: Sample Balance Sheet

| Category | Amount (£) |

|---|---|

| Current Assets | £150,000 |

| Investments | £50,000 |

| Property | £300,000 |

| Equipment | £100,000 |

| Total Assets | £600,000 |

| Current Liabilities | £50,000 |

| Long-term Liabilities | £200,000 |

| Total Liabilities | £250,000 |

Table 2: Debt to Asset Ratio Calculation

| Category | Amount (£) |

|---|---|

| Total Liabilities | £250,000 |

| Total Assets | £600,000 |

| Debt to Asset Ratio | 0.4167 |

These tables provide a breakdown of assets and liabilities and then use those figures to calculate the Debt to Asset Ratio.

FAQs

1. What Does a Low Debt-to-Asset Ratio Indicate?

A low ratio signifies a healthier financial position with less reliance on borrowed funds, making it favorable to investors and indicating lower risk.

2. Why is knowing my debt-to-asset ratio important?

Understanding your debt-to-asset ratio helps manage debts better and shows if you are highly leveraged, which means having more debts than assets.

3. Can this calculator also find other financial ratios like the debt-to-equity ratio?

Yes, it can calculate different ratios including the debt-to-equity ratio and return on investment which help show how well your money is doing.

4. How does a good credit score affect my cost of borrowing money?

If you have a good credit score, banks or insurance companies may offer lower interest rates because they see you as less risky when lending money.

5. Does the calculator consider liquidity when looking at my financial health?

Sure! It checks your current liabilities and accounts receivable to measure liquidity, telling how quickly you can pay off short-term debts.

Related Calculators: