Make your financial calculations easier – try the GST Calculator. It’s a simple tool to help you manage your finances more effectively.

RESULTS

Calculating taxes can be as complex as untangling a box of mixed cables. For businesses and individuals alike, figuring out the Goods and Services Tax (GST) on various products and services isn’t just challenging—it’s essential for accurate financial planning and legal compliance.

There’s where tools like a GST calculator come in handy, transforming an elaborate task into a few simple clicks.

Did you know that ever since India consolidated its indirect taxes under the GST umbrella in 2017, there has been significant ease in tax calculation?

From grasping the basics to mastering quick calculations with online tools, we’ll guide you through every step needed to handle your GST with confidence.

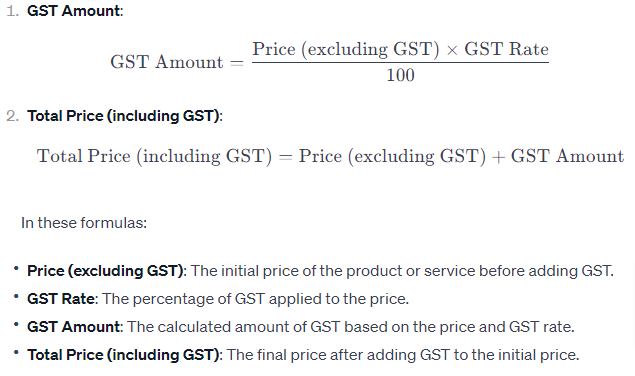

GST Calculation Formula

Grasping the GST Calculation Formula is fundamental for businesses and individuals to determine tax liability with precision. It’s a straightforward process that requires you to apply the current GST rate to the net price of goods or services, ensuring transparent and accurate financial practices.

Formulas

Net Price GST Rate (%) = GST Amount

To find out the GST amount, you multiply the net price by the GST rate. The net price is how much something costs before adding tax. If a book’s net price is $100 and the GST rate is 5%, then you do this: $100 x 5% (or 0.05).

This equals $5. So, the GST amount for the book would be $5.

You add this GST amount to your net price to know what you will pay in total. Using our book example, you take its original cost of $100 and add the GST of $5. Now, your gross amount – what comes out of your pocket – is $105.

Net price + GST Amount = Gross Amount

You need to add the GST amount to the net price to find out how much it all costs in total. This is called the gross amount. If you buy a chair for $100 and the GST rate is 10%, you pay an extra $10 for tax.

So, the full price with tax for that chair is $110.

Figuring out this total can help businesses set prices right and show customers what they’re paying for. Shoppers also see clearly how much tax they give for their items. It makes everything about buying and selling clear and fair.

Everyone knows just how much money goes keeping things simple and honest.

Benefits Of Using A GST Calculator

Harnessing the power of a GST calculator streamlines the tax determination process, empowering businesses and individuals to navigate the complexities of GST with ease. Its precision in delivering rapid results transforms what could be an arduous task into a seamless part of fiscal management.

Easy And Accurate Calculations

Using a GST calculator helps you figure out taxes quickly and right. You just plug in the numbers, like the net price of an item and the tax rate. The calculator does all the work to show you how much tax you need to pay.

It adds up everything, so you get the total amount with tax included. This way, mistakes are less likely because it’s not a person trying to do all that math in their head or on paper.

This tool is great for people who have businesses or deal with taxes often. It takes away stress because they don’t have to worry about making errors in their numbers. The calculator keeps up with changes in tax slabs and rates too.

So whenever there’s an update, your calculations stay correct without extra effort from you.

Saves Time and Effort

Calculating taxes correctly is important for every taxpayer. A GST calculator makes that job quicker and easier. You no longer have to work out numbers on paper or type them into a standard calculator.

This tool does the math in seconds, which saves you lots of time you’d otherwise spend checking your work over and over.

With less effort spent crunching numbers, you can focus more on other parts of your business or service. The chance of making mistakes goes down because the calculator handles all the complicated tax laws for you.

It’s smart enough to add up everything just how it should be, so you don’t have to worry about getting it wrong.

Reduces Human Error

Using a GST calculator not only saves time but also means fewer mistakes. People can make errors when they do math, especially with taxes. A simple mix-up in numbers can cause big problems later on.

With the GST calculator, this risk goes down a lot because the machine does the hard work. It follows tax rules and uses the right formulas to figure out what you owe or what you should charge others without messing up.

Having this tool is like having an expert who makes sure your tax calculations are spotless every time. No more worrying about getting numbers wrong or forgetting to carry over a digit.

You just put in the net price and GST rate, and it tells you how much tax needs to be paid right away—no guess work needed! It’s very helpful for taxpayers who want their businesses to follow all service tax laws perfectly.

Types Of GST In The World

As taxation systems go global, understanding the various types of Goods and Services Tax (GST) implemented across different countries becomes essential for businesses engaged in international trade.

While the fundamental concept behind GST is uniform, applying a value-added tax on goods and services, each country may adopt its unique structure to accommodate local fiscal policies and economic strategies.

Central GST (CGST)

Central GST, or CGST for short, is a tax on goods and services in India. The central government collects this tax when you buy things inside a state. It’s part of the country’s taxation system to make sure everyone shares the cost of public services.

SGST is like CGST, but state governments collect it. They work together so that both the central and state governments get a share of the taxes from products and services sold within their areas.

Next, let’s look at how Integrated GST (IGST) works across different states.

State GST (SGST)

State GST, or SGST, is a tax that state governments in India charge. It replaces the old taxes like VAT and octroi. Each state sets its rate for SGST. When you buy something within your state, you pay CGST to the central government and SGST to your state’s government.

SGST makes sure states earn money from sales of goods and services. This cash helps pay for local things like schools and roads. If you run a business, you can use the input tax credit to lower what you owe in SGST by the amount of GST you already paid on stuff for your work.

Integrated GST (IGST)

Integrated GST or IGST is a tax for goods and services that move from one state to another. For example, if you send a product from California to Nevada, IGST applies. This tax goes to the central government first.

Later, they share it with the states. The rate for IGST is often higher because it combines CGST and SGST.

Businesses need to understand IGST when they sell things across state lines. They add this tax on top of the sale price, so customers know how much they are paying in total. It’s important because it helps keep track of taxes for different places all together under one system.

Union Territory GST (UTGST)

Just like the rest of India uses State GST, Union Territories have their version called Union Territory GST or UTGST. This tax is for goods and services in places like Delhi and Chandigarh.

It works with CGST when items are sold within a Union Territory.

The government made UTGST to help keep things fair between states and Union Territories. Every time you buy something in a Union Territory, you might pay this tax along with the Central Goods and Services Tax.

The money from UTGST helps Union Territories build roads, schools, and hospitals just like SGST does for states.

Features Of Our Calculator

Absolutely! Based on the guide, here are the key features and functionalities that a GST calculator would likely encompass:

- Net Price Input: The calculator allows users to input the net price of the item or service without any taxes included.

- GST Rate: There’s a section to input the GST rate applicable to the product or service being calculated. This allows for flexibility in accommodating different tax rates.

- Calculate Button: A dedicated button initiates the calculation process, allowing the tool to apply the provided net price and GST rate to generate the tax amount and the gross total.

- GST Amount Display: It displays the GST amount separately, showing the precise tax levied on the provided net price.

- Gross Amount Display: The calculator provides the total amount to be paid, including the original net price and the calculated GST amount.

- Accuracy and Precision: The tool ensures accuracy in calculations, reducing human error and guaranteeing correct tax computation.

- Instant Results: It generates results swiftly, saving time and effort, particularly for businesses or individuals dealing with multiple transactions.

- Flexibility in Tax Types: It could potentially cater to different GST types (CGST, SGST, IGST, etc.) if applicable in the user’s region or country.

- User-Friendly Interface: A straightforward and intuitive design makes it easy for users to input data and interpret results, ensuring ease of use for a wide range of individuals, including business owners and tax professionals.

- Adaptability to Changes: The calculator might be designed to update automatically with changes in tax rates, ensuring ongoing accuracy in calculations without requiring manual adjustments from users.

These features collectively make the GST calculator a valuable tool for individuals and businesses, simplifying complex tax calculations and contributing to efficient financial management.

Other Features Of Zoho Books

When it comes to streamlining your business finances beyond mere GST calculations, Zoho Books emerges as a robust solution. This intuitive platform not only simplifies tax compliance but also offers a suite of tools designed for comprehensive financial management and accounting efficiency.

Hassle-Free Accounting

Keeping track of money matters can be tough. Zoho Books makes it easy. With this tool, you can handle your bills, invoices, and reports without stress. This means less time worrying about numbers and more time growing your business.

Zoho Books also helps you follow the rules for goods and services tax (GST). It keeps everything in one place, so you always know what taxes you have to pay. This way, you avoid mistakes that could cost you money or get you in trouble with the law.

It’s a smart choice for staying on top of your game and keeping the tax folks happy!

GST Compliance

GST compliance means following the rules set by the government for GST. For a business, this is very important. If you use Zoho Books, it helps you with this task. It makes sure all your sales, purchases, and taxes match what the government says they should be.

Using Zoho Books also keeps records straight for central excise and state duties. This way, companies can easily see what tax they need to pay or get back as a deduction. The software updates when laws change, so businesses are always up-to-date without hard work.

This helps avoid mistakes and problems with the tax office.

Business Management Tools

Zoho Books comes with powerful business management tools. These help you keep track of your sales, expenses, and inventory in one place. You can create invoices, manage contacts, and get detailed reports to see how your business is doing.

All this saves time and lets you focus on growing your company.

These tools also make sure that everything you do follows the GST rules. You won’t have to worry about making mistakes because the system guides you through each step. With these features, managing a business becomes much less stressful and more efficient. Now you can also assess your company’s profitability with our ROCE Calculator, computing Return on Capital Employed.

Additional Free Tools For GST Calculations

For individuals and businesses looking to streamline their tax calculations, there are additional free tools that complement the GST calculator. These resources not only simplify the process but also ensure compliance with ever-changing tax regulations across different jurisdictions.

VAT Calculator

A VAT calculator helps you work out the value-added tax charged on goods and services. You can find out how much tax is added to your prices quickly. Just put in your net price and the VAT rate, and it figures out the total cost for you.

Using a VAT calculator makes sure you charge or pay the right amount of tax. It keeps your business straight with money rules. This tool takes away guesswork and lets you focus on other important tasks.

Online Indian GST Calculator

Moving from the VAT calculator, an online Indian GST calculator helps you work out your tax needs for goods and services in India. This tool makes it easy to figure out how much GST you have to pay or include in your prices.

You simply type in the cost of your item without GST, then choose the right rate of GST. The calculator does the rest for you. It shows both the tax amount and what you’ll sell it for with GST added.

Businesses find this very handy because it keeps their numbers right and follows tax rules without hassle. People don’t have to be math experts or know all about taxes; the online calculator quickly takes care of all that hard work so they can focus on selling their products or services. Now you can calculate savings efficiently with our Triple Discount Calculator, determining discounts sequentially.

Step-by-Step Guide On How To Calculator Works

Navigating GST calculations becomes a breeze with tools like the BSA Calculator, which provides an uncomplicated process for determining both your tax amount and gross price. Let’s explore this straightforward method of ensuring accurate financial figures in our detailed walkthrough.

- To start with the GST calculator, you put in the net price.

- To calculate GST, users need to know the GST rate. This is the percent of the tax that gets added on top of the net price.

- After entering the net price and GST rate, users are ready to find out the total cost.

Results

Once hit the calculate button, you see two numbers. These are the gross price and tax amount.

- The screen will show the gross price first.

- This is how much you pay in total, including GST.

- Next, it shows the tax amount.

- That’s just the GST part of your total cost.

Let’s say you buy a book for $100, and GST is 10%. Here’s what happens:

- You’ll see $110 as your gross price.

- The tax amount shown will be $10.

This simple display makes understanding costs easy!

Example

Let’s use the GST Calculator as an example. Say you want to buy a book that costs $50, and the GST rate is 10%. You type in $50 for the net price and $10 for the GST rate. After hitting calculate, it shows $5 as your GST amount to pay.

Add this to your net price, and you’ll see the total amount you’ll spend is $55. This tool makes sure you know exactly how much more money leaves your pocket because of tax.

You now know how to use a GST calculator. It’s simple and quick. You save time doing math for taxes this way. This tool helps you avoid mistakes, too. Remember, there are different types of GST around the world, like CGST or IGST.

Use these easy tools to keep your business numbers right!

Here’s an example of a table illustrating the calculation of GST amount and total price (including GST) for a product priced at £100 with a GST rate of 20%:

| Description | Calculation | Amount |

|---|---|---|

| Price (excluding GST) | £100 | |

| GST Rate | 20% | |

| GST Amount | (£100 × 20%) / 100 = £20 | £20 |

| Total Price | £100 + £20 = £120 | £120 |

This table demonstrates how the GST amount is calculated and added to the initial price to determine the total price (including GST) for the product. Evaluate your investment performance using our Return on Asset Calculator, measuring profitability relative to assets.

FAQs

1. What are the benefits of using a GST calculator?

Using a GST calculator ensures easy and accurate calculations, saves time and effort, reduces human error in tax computations, and helps maintain compliance with evolving tax laws and rates.

2. How does Zoho Books assist in GST compliance and financial management?

Zoho Books simplifies accounting processes by managing bills, invoices, and tax compliance, including GST. It ensures accuracy in financial records, updates automatically with changing laws, and provides tools for comprehensive business management.

3. What other free tools complement a GST calculator?

Additional tools like the VAT calculator help compute value-added tax quickly and accurately. Online Indian GST calculators are specialized tools for determining GST for goods and services in India, aiding businesses in adhering to tax regulations.

Related Calculators:

- Pre/Post Calculator

- Market Capitalization Calculator

- Stamp Duty Calculator AU

- Ending Inventory Calculator

- Debt to Asset Ratio Calculator