You can efficiently assess the performance of your business using our ROCE (Return on Capital Employed) calculator. Simply input the required financial data, and the calculator will provide you with the ROCE value.

RESULTS

Are you trying to figure out how efficiently your business is using its capital? Understanding the return on capital employed, or ROCE, is crucial for investors and business owners alike.

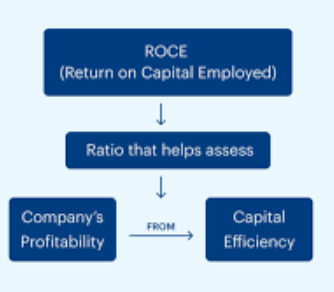

Understanding Return On Capital Employed (ROCE)

Dive into the world of ROCE, a pivotal financial ratio that offers a clear snapshot of how effectively a company is using its capital to generate profits. Grasping this concept is crucial for investors aiming to assess the operational efficiency and profitability of potential investment opportunities.

Definition

Return on Capital Employed (ROCE) is a financial ratio. It tells you how well a company uses its capital to make money. Think of it like a score that shows the bang for each buck used in the business.

To get this score, we look at two things: profits before paying interest and taxes (EBIT) and the total amount of money invested in the company (capital employed). Capital employed means all the cash that’s tied up in doing business, including money put into buildings and machines, minus any debts due soon.

ROCE is important because it gives an idea of how good a company is at turning investments into profits. Companies aim for a high ROCE because it usually means they’re using their resources effectively.

Investors care about ROCE too; it helps them decide where to put their money to get good returns. By comparing ROCE across different companies or industries, you can see which ones are truly shining when it comes to making money from what they have.

Importance

Knowing ROCE helps you see how well a company uses its capital. It tells if the money invested in the business makes good profits. Think of it like checking your car’s miles per gallon to know if it’s running well.

For businesses, higher ROCE means they’re getting more power from their engine – the invested cash.

Companies use ROCE to make smart choices about where to put their money. It guides them when buying new things or starting projects that could earn more money. This number is also great for comparing different companies or seeing changes over time within the same business.

When investors look at this, they can pick stocks that might bring better returns and avoid ones that aren’t using their resources wisely. Now you can analyze your return on assets using our intuitive Return on Asset Calculator.

How To Calculate ROCE

Calculating ROCE is easier than you might think, boiling down to a simple formula that marries your EBIT with capital employed. This calculation offers a clear snapshot of how effectively a company is using its capital to generate profits, and we’ll show you how it’s done.

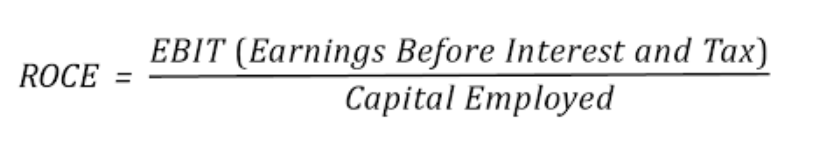

Formula

To find out how well a company uses its capital to make money, we use the ROCE formula. It’s like a recipe for baking a cake, but instead of flour and sugar, we combine earnings before interest and taxes (EBIT) with the difference between total assets and current liabilities.

This mix gives us an idea of how the business is doing with what it has.

The actual calculation looks like this: you take EBIT from the income statement and divide it by total assets minus current liabilities from the balance sheet. What comes out is your ROCE in percentage form. Now you can also calculate percentages easily with our Percentage Calculator.

It shows investors how much profit each dollar of invested capital generates. And that’s important because it helps tell if putting money into a business will yield good returns or not.

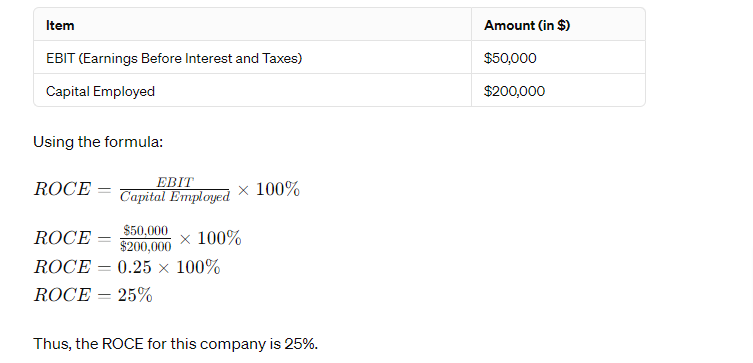

Example Calculation

Let’s say a company earns $50,000 before interest and taxes (EBIT) and has a total of $200,000 invested in capital. To figure out the return on capital employed (ROCE), you would use these numbers.

You divide the EBIT by the capital employed. So, you take $50,000 and divide it by $200,000 to get 0.25 or 25%. This means for every dollar the company puts into its business, it makes 25 cents back.

Understanding this result helps people see how well a company turns its money into profits. The next step is looking at what this number tells us about business performance compared to others in the same game.

Now let’s move on to interpreting what a good ROCE ratio looks like.

Interpreting The ROCE Ratio

Interpreting the ROCE ratio goes beyond just crunching numbers—it’s about understanding what those numbers say regarding your company’s efficiency in using capital to generate profits.

Let’s dive deeper and see how this financial metric can give us insights into a business’s operational performance and value creation.

What Is a Good ROCE?

A good ROCE means a company can turn its capital into profit efficiently. Usually, a higher percentage is better. Experts often say that a ROCE of at least 10–15% is solid. It shows the business makes more money than it spends on its capital costs, like loans or investments.

But what’s good can change between different industries.

Businesses compare their ROCE with other companies to see how well they are doing. If their ROCE is much lower than others in the same field, this might be a sign they need to check how they use their money and make changes.

On the other hand, if their ROCE is higher, they’re likely to use their resources well to grow profits.

Compared To Industry Standards

Knowing if a ROCE is good often means looking at other companies in the same industry. Different industries have their own average ROCE values. For example, technology firms might have higher ROCEs because they don’t need big factories like car makers do.

Companies with a lot of expensive equipment, like oil drillers, usually have lower ROCE because their capital costs are high.

So when you use an ROCE calculator, it’s smart to compare your results with others in your field. This can show you how well you’re using your money compared to them. If your number is higher than most in your industry, that’s great! It could mean you’re doing something better than your competitors.

Now let’s look into “ROCE vs. ROIC: Understanding the Differences.”.

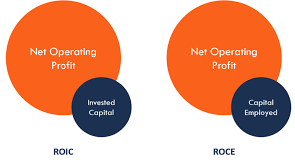

ROCE vs. ROIC

ROCE and ROIC may seem similar, but they are different ways to measure how well a company uses its money. ROCE stands for Return on Capital Employed and shows how much profit a company makes from all the capital it uses, including debt and equity. This means it looks at what the business earns before paying any interest or tax.

On the other hand, ROIC is short for Return on Invested Capital and focuses only on the money that shareholders and debt holders have put into the company. It tells us how good a company is at turning its direct investments into profits.

Think of ROIC as just looking at the core funds used in running day-to-day business activities without extra debts like loans for big one-time purchases.

Now let’s talk about why using our calculator can make things easier for you.

Benefits Of Calculator

Moving from the differences between ROCE and ROIC, it’s clear that having a good tool is key for smart money choices. A ROCE calculator brings many perks. It saves time because you don’t have to do math by hand.

This means you can make decisions faster. The calculator also keeps mistakes low. When you put in numbers, it handles the tricky parts and gives back the correct answers.

With this tool, understanding your business’s health becomes easier. You can see how well your money is being used to earn more of it. Plus, using the same steps every time helps compare different investments or times in your company’s life.

This makes sure you’re always on top of where your business stands financially. Now you can also analyze inflation rates with our comprehensive Inflation Calculator.

Features Of Our Calculator

Our ROCE calculator is easy to use and gives fast results. You just type in the numbers, and it works out the return on capital employed for you. It’s great for comparing how well a company uses its capital to make money.

The calculator also helps you see if a business is doing better than others in its field.

It shows clear steps so anyone can follow along, whether you know a lot about finance or just a little. Use this tool to check on investments or figure out where your business stands.

Our calculator does the hard math, so you don’t have to worry about making mistakes with tricky equations and terms like EBIT or non-current liabilities.

Step-by-Step Guide On How The Calculator Works

Sure, let’s dive into the ease of using our ROCE calculator. With just a few clicks, you’ll seamlessly navigate through inputting your financial data to instantly discover your company’s efficiency in utilizing its capital.

No need for complex calculations or spreadsheets; our tool streamlines the process, putting valuable insights at your fingertips in real-time. Are you ready to unlock this aspect of financial analysis? Let’s get started!

- Enter EBIT: Input operating profit into the calculator, excluding interest and tax.

- Enter Fixed Capital: Add long-term assets from the balance sheet, excluding quickly liquidated items.

- Hit Calculate: Click the button for instant ROCE results, gauging capital efficiency.

- Result: Evaluate ROCE percentage to guide investment decisions and business growth.

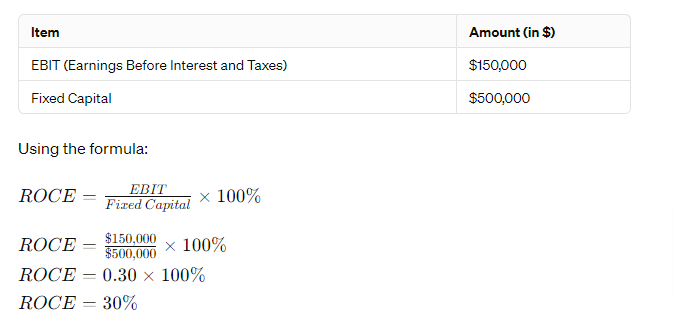

Example

Let’s say a business earns $150,000 in EBIT (earnings before interest and taxes) in one year. This company has fixed capital worth $500,000. To find out the ROCE, you use the calculator like this: First, put in the EBIT number, which is $150,000.

Next, type in how much fixed capital there is—$500,000 for this example. Then click the calculate button. The calculator shows that the ROCE for this business is 30%.

So, you’ve learned what ROCE is and why it’s important. You know how to find it with a simple formula. Our calculator even makes it easier for you to figure out your numbers without stress.

Remember, checking ROCE helps you see how well a company uses its money. If you want more help or information, lots of tools are out there for you to use. Go ahead and try using the ROCE calculator; it could help make smarter choices in business!

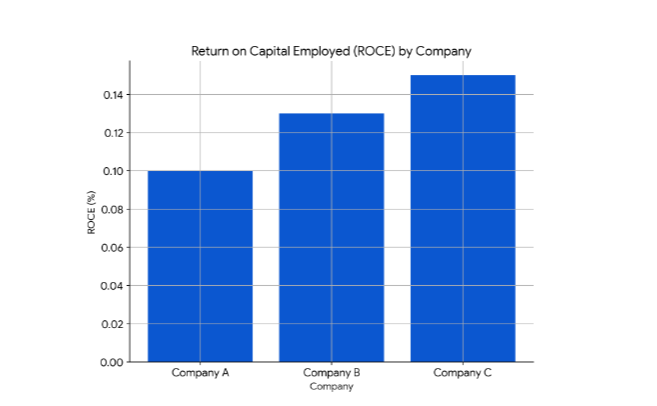

Graphical Representation for ROCE Calculator

FAQs

1. How does knowing my business’s ROCE help me?

Knowing your business’s ROCE can tell you if you’re using your investments well to make more money compared to the costs like debts and expenses.

2. Can using the ROCE formula affect my stock-picking decisions?

Yes, when you figure out a company’s returns on capital with the ROCE formula, it can help decide if buying their stock is good or not based on performance.

3. Is there a difference between return on invested capital (ROIC) and return on equity (ROE)?

Yes, they are different! Return on invested capital looks at both debt and shareholder funds in making money while return on equity focuses only on shareholder funds.

Related Calculators: