Maximize your financial planning with our Inflation UK Calculator. Easily assess the impact of inflation on your expenses, ensuring informed decisions for a secure financial future.

RESULTS

As prices rise, figuring out how much more expensive your shopping will become can feel like a chore. Did you know that UK inflation has fluctuated significantly over the centuries? This guide will help you to understand and use an Inflation UK Calculator to make sense of what those changes mean for you.

What Is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power over time. It’s a key economic indicator that reflects how much more expensive your living costs will become as each year passes.

How Does It Affect The Value Of Money?

Inflation makes each pound worth less over time. This means you need more pounds to buy the same things you did before. Think of it like this: if a loaf of bread costs £1 one year, but due to inflation the price goes up, you might have to pay £1.05 for that same loaf next year.

Your money buys less as prices rise.

The value of your savings can also go down because of inflation. Imagine saving £100 in a jar at home for a year. If prices go up by 3% during that year, what you could buy with that £100 has now gone down because things cost more.

You lose purchasing power when your money doesn’t grow as fast as prices do. Also, try our Inflation Calculator, understand the impact of inflation on your purchasing power over time, and plan your finances accordingly.

Understanding The Inflation Calculator

An inflation calculator helps you see how prices change over time. It shows the difference in buying power of a certain amount of money from one year to another. You use this tool by putting in an amount of money and picking two years.

It then calculates how much that money would be worth in the second year, considering changes in the cost of living.

The calculator uses something called the Consumer Price Index to figure out these shifts. This index tracks how prices for everyday items move up or down each year. With this handy device, you can understand how inflation has changed your money’s value over periods both short and long.

Next, we’ll explore historical UK inflation rates and what they tell us about past economic trends.

Historical UK Inflation Rates

| Year | Inflation Rate (%) | Notes |

|---|---|---|

| 1209 | Data not available | Earliest historical estimates |

| 1500 | Data not available | Tudor period, the beginning of price recording |

| 1665 | Data not available | Recoinage and the Great Plague of London |

| 1800 | Data not available | Industrial Revolution period |

| 1914 | 2.9 | Outbreak of World War I |

| 1920 | 15.5 | Post-World War I economic challenges |

| 1945 | 2.8 | End of World War II |

| 1970 | 6.4 | Decimalisation of British currency |

| 1980 | 18.0 | Height of inflation in recent history |

| 1990 | 9.5 | Early 90s recession |

| 2000 | 3.0 | Start of the new millennium |

| 2010 | 3.3 | Post-financial crisis recovery |

| 2020 | 0.9 | Impact of the COVID-19 pandemic |

| Present | Varies | Continued economic development |

This table showcases selected years where significant economic events occurred, affecting the inflation rates. Data before the 20th century is less precise due to the absence of a standard measure for inflation. However, recorded rates from the early 1900s provide a clearer picture of inflation’s trajectory through times of war, peace, and economic shifts. The UK Consumer Price Index (CPI) now offers annual inflation rates, crucial for financial analysis and planning.

Official UK Consumer Price Index

The Official UK Consumer Price Index (CPI) is an essential measure that reflects the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. To understand the historical progression of inflation rates in the UK, the CPI provides a valuable point of reference, tracking how prices have evolved from one year to the next.

| Year | Annual CPI | % Change from Previous Year |

|---|---|---|

| 2020 | 108.5 | +1.5% |

| 2021 | 111.1 | +2.4% |

Focusing on the CPI helps individuals and businesses gauge the purchasing power of their money. The CPI’s upward or downward movement can indicate periods of inflation or deflation, respectively. These fluctuations will directly impact the cost of living, salaries, pensions, and even government policies.

Incorporating these insights into financial decision-making is crucial. Individuals planning for retirement, saving for education, or investing in the market need to factor in the potential erosion of their money’s value over time due to inflation.

Understanding the Inflation Calculator Formula for the UK

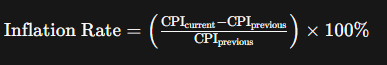

The inflation rate in the UK is typically measured using the Consumer Price Index (CPI). The formula for calculating inflation using CPI is:

Where:

- CPIcurrent is the Consumer Price Index in the current period.

- CPIprevious is the Consumer Price Index in the previous period.

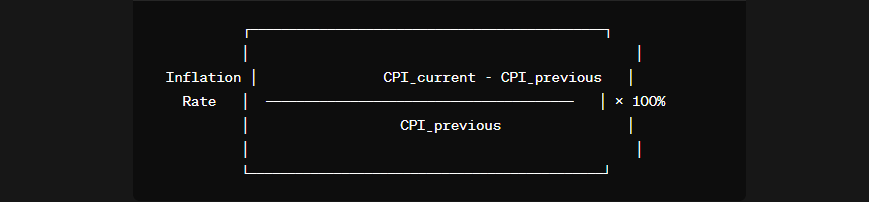

Here’s a graphical representation of this formula:

In this graphical representation:

- The numerator of the formula (CPIcurrent−CPIprevious) is represented on the top.

- The denominator of the formula (CPIprevious) is represented at the bottom.

- The division operation is depicted by the horizontal line separating the numerator and the denominator.

- The multiplication operation by 100% is shown as an arrow pointing to the right.

Importance Of Tracking Inflation

Understanding the swings in inflation is crucial for individuals and businesses alike, as it guides decisions on savings, pricing strategies, and long-term financial planning. Recognizing how inflation impacts purchasing power can help you make more informed choices about managing your finances in an ever-changing economic landscape.

How It Can Affect Your Savings And Investments

Inflation can make the money you save worth less over time. If you have $100 in savings. If prices go up, the things you could buy for $100 today might cost more tomorrow. This means that your $100 will not be able to buy as much as it could before.

Your investments also face a similar issue. When inflation is high, if your investments don’t grow faster than inflation, they lose real value.

To protect your savings and keep growing your wealth, it’s important to think about inflation when you plan for the future. Look for ways to increase your savings growth at a rate that beats inflation.

This helps ensure that when you’re ready to use your money, it will still have strong buying power even after many years. Also, try our Term Deposit Calculator, a useful tool for estimating returns on your term deposits and planning your investments.

Benefits Of Using An Inflation UK Calculator

An Inflation UK Calculator helps you see how prices change over time. It shows you the value of money in different years. Putting £100 in the calculator from 1990 tells you what that £100 is worth today.

This tool helps people who want to understand how inflation affects their buying power.

Using this calculator also guides your financial choices. For example, if you are saving for a house or retirement, knowing about inflation can help make better plans with your money.

The tool takes information like CPI (Consumer Price Index) and uses it to show how costs rise or fall. This means you can be smarter with your money and plan for big expenses.

Step-By-Step Guide On How The Works

To effortlessly understand the purchasing power of your money over time, our Inflation UK Calculator offers a simple step-by-step process—just input your figures and instantly see how inflation impacts your finances.

Continue reading to explore this essential financial tool in detail.

- Input the money amount without symbols or commas, rounding up or down if there are cents.

- Locate and input the “Base Year” using the drop-down menu or typing it in.

- Select the desired end year for analyzing inflation trends.Pick the current year for recent data, a past year for historical context, or an upcoming year for future planning.

- After entering the necessary details, click the “Calculate” button. The calculator uses official data like the Consumer Price Index (CPI) to provide accurate results.

- Receive a comprehensive set of results, including cumulative price change, average inflation rate, converted amount, price difference, CPI figures for both base and end years, and a visual chart illustrating inflation progression.

- Analyze the output to understand how inflation has affected the money’s value over time. Gain insights into purchasing power changes, annualized inflation rates, and the equivalent value of the initial sum in today’s terms.

Example

Let’s say you have £1000 from 1990, and you want to know how much it would be worth in today’s money. You would enter £1000 as the Amount, 1990 as the Base Year, and the current year as the End Year into our Inflation UK Calculator.

After hitting calculate, you’ll see not just how much your £1000 has changed in value but also get a detailed chart showing yearly inflation rates and amounts. The calculator uses consumer price index data to show that the same basket of goods that cost £1000 in 1990 will likely cost more now because prices generally go up over time.

This tool is great for understanding how past pounds compare to present value using historical economic indicators like Consumer Price Index (CPI) figures provided by official sources such as the Bank of England or Office for Budget Responsibility.

It helps make smart choices about money knowing what inflation does to its buying power over the years.

In summarizing the significance of an inflation calculator for UK residents, one must appreciate its role as both a reflective and prognostic financial tool. Embracing this resource equips individuals with a clearer understanding of purchasing power shifts over time, fostering more informed decision-making in personal and investment finances.

The value of tracking inflation

Tracking inflation is key to understanding how prices go up over time. If you know about inflation, you can make better choices with your money. It helps you figure out if the cash in your savings will buy less in the future.

When prices increase, your money buys less than before.

People who save or invest need to watch inflation closely. They want their money to grow and not lose power as costs rise. Knowing inflation rates lets them pick where to put their money so it can keep up or beat price jumps.

This way, they protect the value of what they’ve saved for things like retirement or big purchases down the road. Also, try our PVIFA Calculator, a helpful tool for calculating the present value interest factor of annuity, aiding in financial planning and investment analysis.

Using the Inflation Calculator for financial planning

Knowing how prices change can help you make smart money choices. An Inflation Calculator is a key tool for this. It helps you see how inflation might eat into your cash over time. If you’re saving for a house, retirement, or college, the calculator shows how much more you will need as years pass.

Planning with an inflation calculator keeps surprises away from your budget. Use it to determine if your savings and investments are keeping up with rising costs. This way, you’ll stay ahead and keep your plans safe.

Your money should grow enough to buy what it can now, even many years later.

FAQs

1. How does the Retail Price Index affect inflation calculations?

The Retail Price Index measures how much prices for goods and services go up. This helps us understand how much more money people need to live as things get costly.

2. Can an inflation calculator tell me about the cost of living?

Yes, by using things like the Consumer Price Index, an inflation calculator can give you an idea of changes in the cost of living by comparing prices from different times.

3. Does GDP play a role in measuring inflation with a calculator?

Gross Domestic Product, or GDP, doesn’t directly fit into an individual’s use of an inflation calculator but it is part of understanding a country’s overall economic health which relates to inflation levels.

4. Why might I want to use an Inflation UK Calculator?

You’d use this tool if you want to see how much value the U.K. Pound has lost due to price increases and how that affects incomes and savings over time.

5. How can individuals use an Inflation UK Calculator for better financial planning?

By using an Inflation UK Calculator, individuals can assess how inflation might affect their savings and investments over time. This tool aids in making adjustments to financial plans to ensure that money retains its purchasing power in the face of rising prices.

6. What are the key features of an Inflation UK Calculator, and how can it assist with financial decisions?

An Inflation UK Calculator offers various features such as the ability to enter any amount, choose specific years for comparison, provide quick results, offer detailed breakdowns including CPI data, and present easy-to-read charts. This tool assists in forecasting potential future values and aids in planning savings and investments.

Related Calculators: