Make your calculations hassle free with the Straight Line Calculator. Simplify linear equations effortlessly and save time. Try it now for quick and accurate results.

RESULTS

Calculating straight lines can be tricky, especially when dealing with financial figures or geometric problems. Did you know that a Straight Line Calculator simplifies this process by providing quick and accurate results? Our guide will walk you through using this handy tool to make your calculations effortless and reliable. Keep reading to discover how it can streamline your tasks!

Definition Of a Straight Line Calculator

A Straight Line Calculator is a tool that helps you work out numbers for straight line depreciation. In business, when you buy something like a machine or computer for work, it loses value over time.

This calculator makes it easy to figure out how much value the item loses each year until it’s worth its final value or salvage value. You put in the cost of the asset, how long you think it will last (useful life), and what you can sell it for at the end (salvage value).

The calculator then shows you the yearly loss in value which is called depreciation expense.

Using this calculator can help with money plans and tax reports in businesses. It tells you how much money to set aside each year to cover the cost of things as they get old and worn out.

This way your accounts stay accurate and up to date without doing all the math by hand. Discover the power of precision with our Pythagorean Theorem Calculator. Unleash the ease of accurate calculations now!

Importance Of Calculating Straight Lines

Knowing how to calculate straight lines is key in many areas. For example, if you’re working with graphs, you might need to find the slope (m) or y-intercept (b). These are parts of an equation for a line on a graph.

The slope shows how steep the line is and which way it goes. The y-intercept tells where the line crosses the y-axis.

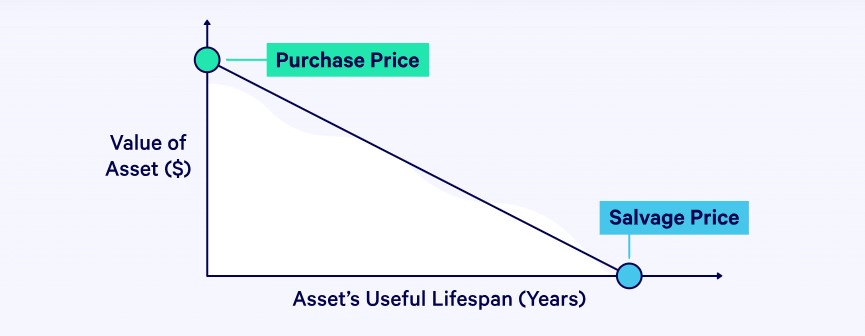

In business, knowing about straight lines helps too. When companies buy things like machines or cars, those items lose value over time. This loss is called depreciation. A type of depreciation that uses straight lines is “straight line depreciation.” It spreads out the asset cost evenly across its useful life into each fiscal year until it reaches its salvage value or residual value at the end.

This makes sure that financial reports show expenses fairly over time.

Understanding Depreciation

Understanding depreciation is essential for accurately capturing the decline in asset values over time, and exploring this financial concept can significantly enhance your fiscal strategies—keep reading to discover more about its mechanisms.

Definition Of Depreciation

Depreciation is a way to spread out the cost of something expensive over the time you use it. Imagine you buy a new car; as soon as you drive it off the lot, it’s worth less. Each year, its value goes down because it gets older and wears out.

This loss in value is what we call depreciation.

Businesses care about depreciation for things like machines or buildings. It helps them know how much money they need to set aside each year so that when these items are too old or broken, they have enough saved to replace them.

Depreciation is an important part of planning for businesses because it affects their taxes and shows up on reports like income statements. There are different ways to figure out depreciation, such as the double declining balance method or straight line method which spreads costs evenly over time.

Methods Of Depreciation

Understanding how value goes down over time is key. There are a few common ways to figure this out for things like machines and buildings.

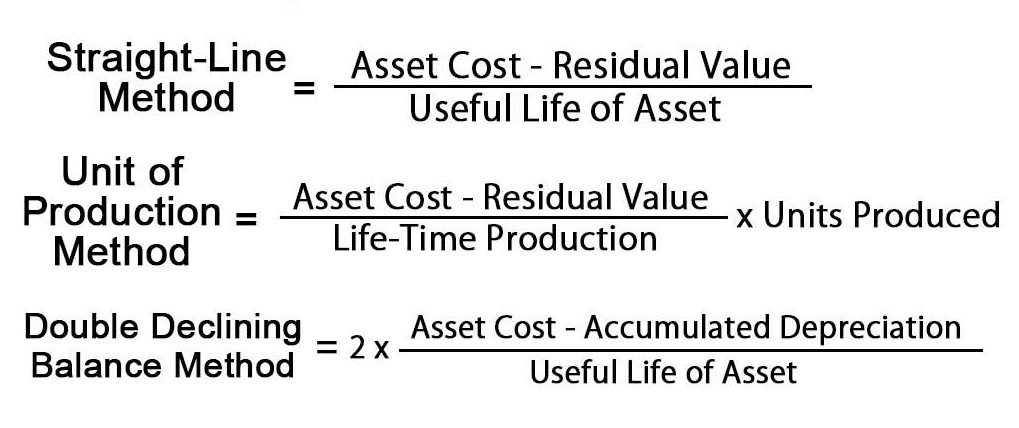

- Straight line depreciation: This is the simplest way. You take the cost of the item and then subtract its salvage value, which is what you think it will be worth at the end of its life. Divide that number by how many years you think it will last to find out how much value it loses each year.

- Declining balance method: In this way, items lose more value in the first few years. Each year, you take a set percentage off the remaining value instead of spreading the cost evenly over time.

- Sum of the years’ digits method: This one’s a bit tricky but it works kind of like declining balance. Add up all the digits from 1 to the number of years (for example, if it’s 5 years, you’d do 1+2+3+4+5). In each year, you lose a fraction of its starting value based on those numbers.

- Units of production depreciation: If something is used a lot, it might lose value faster. Here, you see how much work an item does each year and use that to figure out depreciation.

- Double declining balance method: This is like declining balance but twice as fast. It’s good for things that become less useful very quickly.

Benefits Of Using A Straight Line Calculator

Embrace the precision and convenience that a straight line calculator offers, streamlining complex depreciation calculations into clear, manageable results for efficient fiscal planning.

Continue reading to learn more about this indispensable tool.

Accuracy

Our Straight Line Calculator gives you numbers you can trust. It does the math right every time, so you don’t make mistakes with important things like book values or depreciation expenses.

This tool helps make sure everything adds up just as it should.

Users love that they get precise results fast. Whether working out how much something is worth after a few years or figuring out costs for taxes, our calculator keeps the numbers exact and clear.

It uses smart ways to crunch numbers that follow the rules of straight line depreciation methods. Streamline your financial analysis with our PrePost Calculator. Simplify intricate calculations effortlessly.

Time saving

A straight line calculator does more than ensure precision; it also helps people save time. Instead of doing the math by hand, which can take a long time, you can find the answer in seconds with an online tool.

You just put in the numbers and hit calculate. This way, you don’t waste minutes or hours on complex calculations for depreciation or when working out equations of a line.

Businesses love speed and efficiency. That’s why they use tools like this one to get things done faster. This calculator quickly works out everything from salvage values to how much value an asset loses each year using straight line depreciation.

It means you spend less time crunching numbers and more on other important work tasks.

Versatility

Our Straight Line Calculator does more than just figure out depreciation. It can handle various math tasks with ease. You might want to know how far two points are from each other or find the slope intercept form of a line.

This tool has you covered. Whether it’s for school, work, or personal projects, this calculator adapts to your needs.

You can use it for different equations of a line too. Need the point slope form? Or maybe the parametric forms are what you’re after? Just plug in your numbers and let the calculator do its magic.

It simplifies complex linear equations quickly so you don’t have to spend hours on them. This makes it a handy tool for anyone dealing with straight lines regularly.

Features Of Our Calculator

Our online straight line calculator is packed with features that make it easy to work out depreciation and other line calculations. It’s designed to be helpful and user friendly for everyone who needs it.

- It quickly finds the equation of a straight line. You just put in two points, and it does the rest.

- The calculator gives clear, step by step explanations. This helps you understand how it got the answer.

- It has a simple interface. The design makes it easy to find what you need without trouble.

- You can use it to calculate depreciated asset values over time. This is great for knowing how much something has lost in value.

- Our tool works on any device with internet access. Whether on your phone or computer, you can use the calculator anywhere.

- There’s an option for accelerated depreciation. If you need faster calculations, this feature comes in handy.

- It plots out depreciation schedules and graphs for visual understanding. See how value decreases over years in a chart form.

- The calculator also includes horizontal line tests. Check if functions are one to one by drawing horizontal lines across their graphs.

- Users can find x-axis crossings with ease. When you’re looking at graphs, this helps you see where lines go through the x-axis.

- Save results easily for later reference or reports. Just calculate once and keep the information for when you need it again.

Other Uses Of A Straight Line Calculator

Beyond its pivotal role in finance, a straight line calculator serves as a versatile tool for various mathematical and engineering tasks. Its utility extends to spatial calculations and linear problem solving, allowing users to delve into geometry by pinpointing exact line equations or determining distances with precision.

Calculating Distances

Calculating distances can be easy with a straight line calculator. This tool helps you figure out how far apart two points are when you know their locations on a map or graph. You just need the x-coordinate and y-coordinate for each point.

Then, the calculator uses the equation of a line to tell you the distance between them.

Our online calculator does this work fast and without mistakes. It’s great for students, builders, or anyone who needs to measure space from one place to another. Use it to plan trips, build things, or solve math problems about distance. Optimize your financial decisions with our Depreciation Comparison Calculator. Empower your planning, make informed choices, and thrive financially.

Finding Equations Of A Line

A straight line calculator is not just for working with money and depreciation. It can help you find the equation of a line too. This is important when you want to understand how two points on a graph are connected by a straight path.

You might need the slope or the intercepts, which tell where the line crosses the axes.

The calculator makes this easy by doing all the math for you. Just give it two points from your line, like (1, 2) and (3, 4). The tool uses these numbers to figure out everything about your line’s equation quickly.

Now that we’ve covered finding equations of lines let’s look at why our specific calculator stands out from others.

Why Choose Our Straight Line Calculator?

When it comes to managing financial calculations with precision and ease, our Straight Line Calculator stands out as the go to tool for both individuals and professionals. Its user centric design ensures that every calculation is not only accurate but also seamlessly integrates into your workflow, providing a hassle free calculating experience that enhances productivity.

Intuitive User Interface

Our Straight Line Calculator is easy to use. We designed it so that you can find what you need quickly. The buttons are clear, and the layout makes sense. This means you don’t have to waste time figuring out how the calculator works.

You can just start using it right away.

The user friendly design helps make sure your calculations are done fast and without mistakes. It guides you through each step, which means less confusion and more confidence in your results.

Now let’s see how those step by step explanations can boost your understanding even further.

Step By Step Explanation

Our Straight Line Calculator makes depreciation easy to understand. You get a clear breakdown of how it works for any asset. Here’s what happens when you use it:

You start by putting in the asset’s original cost. Next, enter how much it will be worth at the end of its use. Then, tell the calculator how many years this change will happen.

After that, click ‘calculate’. Right away, you see different numbers like how much value is lost each year and simple charts showing this over time.

For example, say you buy equipment for $10,000 that’ll last 5 years and be worth $2,000 at the end. The calculator tells you everything—from yearly loss to what value remains each year—making money matters clearer and easier to manage.

Speed And Efficiency

You want to get things done fast and right. A straight line calculator helps you with that. You don’t waste time guessing or making mistakes. It does the math quickly and gives you answers in seconds.

It also makes sure you follow the rules for calculating depreciation each step of the way. This means you can trust the numbers it gives you for your reports or taxes. No need to double check everything, which saves even more time! Refine your calculations with finesse using our Rounding Calculator, unlock accuracy effortlessly

Step By Step Guide On How The Calculator Works

Discover the simplicity of our Straight Line Calculator as we guide you through its seamless process, ensuring you’ll swiftly calculate depreciation without hassle. Keep reading to harness the full potential of this indispensable tool.

- Asset Value: To use the straight line calculator, first, you need to know your asset’s value. This is how much you paid for it.

- Final Value: You need to know the final value of an asset after its useful life. This helps calculate how much value it lost while you used it.

- Depreciation Period: In this step, users decide how many years the asset will lose value. This period is called the depreciation period.

- ‘Calculate’ Button: After you’ve entered all your information, it’s time to see your results. Pressing the calculate button will start the process.

- Result: Upon using our Straight Line Calculator, users obtain a comprehensive breakdown of the asset’s depreciation. The results display key financial information, crucial for accurate accounting and planning. The results equip users with a clear understanding of their asset’s value throughout its useful life, essential for both financial reporting and strategic decision making.

Example

Let’s say you own a computer worth $1000 and expect it to have no value after five years due to depreciation. To find out how much value it loses each year, you use our Straight Line Calculator.

You put in the original cost of $1000, an end value of $0, and a time frame of 5 years.

The calculator quickly tells you that each year your computer will lose $200 in value. It also shows you a chart with the yearly details: starting at $1000, by the end of the first year it drops to $800, then down to $600 after two years, and so on until it reaches zero at the end of year five.

This makes planning for future expenses much easier since you know exactly how much your asset’s value will change over time.

Our Straight Line Calculator makes figuring out depreciation simple and quick. It’s a tool you can trust for correct numbers every time. Have you thought about how much easier your calculations would be with it? Imagine the extra time you’d have, not to mention how clear everything seems with our step by step guide.

Take the step towards effortless financial math, try our calculator today!

FAQs

1. Why should I use the straight line method for depreciation?

Use the straight line method because it’s simple and spreads the cost of an item evenly across its useful life.

2. Can I use the Straight Line Calculator for three or more points?

Most Straight Line Calculators are designed for two point calculations. However, you can use the calculator multiple times for additional points or use advanced tools that support multiple points.

Related Calculators: