Maximize your financial insights by utilizing the “Depreciation Comparison Calculator.” Easily compare depreciation methods to make informed decisions for optimal asset management. Empower your financial planning today.

RESULTS

Understanding the value of your assets over time can be like trying to hit a moving target. Whether you’re a small business owner, an accountant, or simply trying to get a handle on your company’s finances, grappling with depreciation can quickly become overwhelming.

From vehicles to machinery, knowing how much your investments are worth year after year is crucial for making informed financial decisions.

Did you know that there isn’t just one way to calculate depreciation? That’s right—various methods exist, and each paints a different picture of an asset’s financial journey.

This guide will help you through the murky waters of depreciation with our Depreciation Comparison Calculator. We’ll show you how this tool brings clarity and simplicity to comparing different depreciation methods so that you can confidently understand and maximize the value of your assets.

What Is Depreciation?

Moving from the general idea of asset management, let’s focus on depreciation. Depreciation is how we keep track of an item losing value over time. Imagine you buy a new car; it doesn’t stay as valuable as when you first bought it.

Each year, that car becomes worth a bit less because it gets older and wears out; this decrease in value is what we call depreciation.

It matters for things like machines, buildings, and equipment for work too. When a business buys these big items, which are called fixed assets, they can’t just say they lose all their value right away.

Instead, the business spreads out the loss across the useful life of each item. They do this to match up with using the asset to make money and also for tax reasons since depreciation is often tax-deductible.

This spreading out helps them know how much they spend (depreciation expense) every year due to these items getting older or used up.

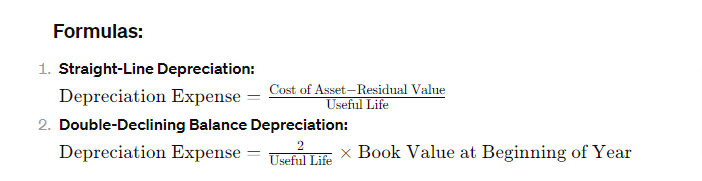

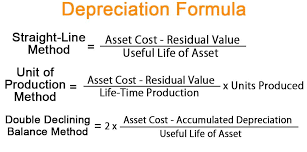

Formulas

Types Of Depreciation Methods

Understanding the various types of depreciation methods is essential for businesses and investors to accurately track the diminishing value of their tangible assets over time. Each method offers a unique approach to allocating an asset’s cost, affecting both the balance sheet and income statement throughout an asset’s lifecycle.

Straight-Line

Straight-line depreciation is a way to figure out how much of an asset’s value gets used up each year. You start with the asset’s cost, take away the salvage value you think it will have at the end, and spread that amount evenly over its useful life.

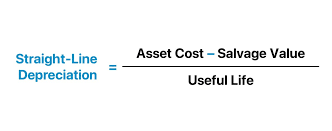

Formula

This gives you a fixed annual expense. Using this method makes it simple for businesses to predict their expenses.

You calculate straight-line depreciation by dividing the difference between an item’s purchase price and its predicted salvage value by the number of years it’s expected to last.

This type of calculation helps keep your financial records steady since you write off the same amount every year. Now let’s talk about “declining balance.”.

Declining Balance

Moving from the consistent expense of straight-line depreciation, the declining balance method speeds things up. This approach causes more costs to hit the books in the early years and less later on.

It’s like taking bigger bites out of your asset’s value at first, then nibbling away as time goes by.

Declining balance depreciation is great for items that lose their worth fast. Imagine you buy a fancy computer; it’s not going to be worth as much after that new model comes out next year.

So, with this method, you write off more money right away when the computer is newest. That means your reported profit might look smaller at first but will grow down the line as costs drop off.

The sum of the year’s digits is a method to work out how much value an asset loses each year. First, add up all the years in the asset’s life. For example, if an asset will last for five years, you would add 5+4+3+2+1 to get 15.

This number is important because it helps figure out each year’s expenses.

Next, start with the biggest number from your count for the first year—for instance, using five for the first year if your asset has a life of five years—and then go down one each year after that (four for the second year, and so on).

Divide this by your total from before to find out what part of the cost you need to charge as depreciation expense for that year. This way, it spreads out how much money you lose over time if something gets old or worn out fast at first but slower later on.

Units Of Production

Units of Production is a different depreciation method because it’s based on how much you use the asset. Think about a machine in a factory: the more you use it, the more it wears out.

So with units of production, each year you might depreciate the machine based on how many things it made or hours it worked. It’s like counting miles for a car—more miles mean more wear and tear.

This way, if your machine works hard one year and less another year, your depreciation matches its real use. You figure it out by estimating how much work the asset can do over its life, say 500,000 widgets or 20,000 hours.

Then track actual production or hours each year to find your expenses. This makes sure your books reflect what’s happening with your assets. Now you can also calculate depreciation using the straight-line method with ease. Access the Straight Line Calculator to streamline your calculations.

Benefits Of Our Calculator

- A depreciation calculator makes it easy to figure out how much the value of an asset goes down over time. With just a few clicks, you can see your item’s current book value and its expected resale value in the future.

- This tool is fast and saves you from doing tricky math alone. It also helps you make smart choices about when to sell or replace something.

- Using this calculator can help businesses plan their money better by showing them their yearly depreciation expenses. For anyone who owns things that lose value, like cars or machines, knowing these costs is very helpful.

- It gives a clear picture of how losing value affects overall net profits and helps with tax reports too, since some types of losing value can be written off during tax time.

Features Of Our Calculator

Our depreciation comparison calculator offers several key features to help you understand how assets lose value. It’s designed to be user-friendly and provide accurate results quickly.

- Choose different methods: You can pick from straight-line, double-declining balance, or other methods to see how they compare.

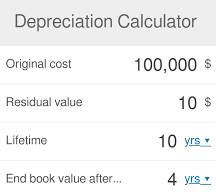

- Input variety: Easily enter your asset value, the depreciation period, and salvage values.

- Immediate results: Click the calculate button and instantly see the depreciation schedule.

- Clear comparisons: The tool shows side-by-side results for different methods, so you can make informed decisions.

- Save time: Avoid manual calculations and get quick answers without complex math or spreadsheets.

- Always accessible: Use the calculator any time online without needing special software or apps.

How A Depreciation Calculator Can Help

A Depreciation Comparison Calculator can streamline your financial planning by providing clear insights into how different depreciation methods impact an asset’s value over time, inviting you to discover more about its practical applications.

Straight Line Calculation

To calculate depreciation using the straight-line method, you first need the asset’s initial cost. Then, decide how many years it will last; this is its life cycle. The calculator takes these numbers and splits the cost evenly over each year.

So if a printer costs $1,000 and lasts 5 years, it depreciates $200 per year.

Using our calculator makes this simple. Just put in the purchase price of what you bought and how long you expect to use it. Hit ‘calculate’, and see how much value your item loses with time—no need for pencils or confusing math.

It shows book values at every step so that you can plan your finances better.

Declining Balance Calculation

Moving from the steady pace of straight-line depreciation, let’s look at declining balance calculation. This method speeds things up. It lets an asset lose more value in the early years and less later on.

Think of it as accelerated depreciation. You multiply the book value at the start of the year by a set rate to find each year’s depreciation.

The double-decreasing balance is a common choice here. It uses twice the annual percentage rate of straight-line depreciation. So if your desk loses 10% each year in a straight line, with a declining balance, it would drop 20% from its current worth each time. This means your desk’s value decreases faster at first but slows down over time. Need to calculate the present value interest factor of an annuity? Use the PVIFA Calculator for quick and accurate results.

Step-by-Step Guide On How Our Calculator Works

Dive into our user-friendly Depreciation Comparison Calculator, where you’re just a few clicks away from gaining clear insights on different depreciation strategies for your assets. Keep reading to uncover the simple process that brings precision to your financial planning.

- Find the purchase price and associated costs of the asset to determine its current value.

- Choose the depreciation period based on how long you plan to use the asset and input it into the calculator.

- Use the straight-line method by entering the original cost, estimated useful life, and any scrap value into the calculator.

- For declining balance depreciation, select a percentage for the rate of value drop and input it, considering any salvage value.

- Click the “Calculate” button to obtain the asset’s depreciation value.

- Review the comprehensive depreciation schedule, displaying annual depreciation, starting value, and remaining value, allowing for informed comparisons between straight-line and declining balance methods.

Example

Let’s say you bought a car for your business, and it costs $20,000. You expect the car to last 5 years before it gets too old to use. For straight-line depreciation, you would count the same cost each year.

So every year, you subtract $4,000 from the value of the car. If instead you choose declining balance depreciation, it means taking away a bigger part of the car’s value in the first few years and less later on.

Our calculator can show these two ways side by side with just a few clicks. Imagine entering your $20,000 into our tool as asset valuation and picking 5 years for depreciating your car.

Here’s a table illustrating the depreciation of the car using both straight-line and declining balance methods over a 5-year period:

| Year | Asset Valuation ($) | Straight-Line Depreciation ($) | Declining Balance Depreciation ($) |

|---|---|---|---|

| 1 | $20,000 | $4,000 | $8,000 |

| 2 | $16,000 | $4,000 | $6,400 |

| 3 | $12,000 | $4,000 | $3,840 |

| 4 | $8,000 | $4,000 | $2,304 |

| 5 | $4,000 | $4,000 | $1,382.40 |

You then put in how much you want to drop each year using the straight line or declining balance methods. After hitting calculate, our calculator quickly tells you what your car is worth each year until it reaches five years old.

This way, comparing becomes easy and helps make better choices for money-saving tasks like taxes or when to sell an item.

Understanding depreciation helps you know how things lose value. With our calculator, you can compare different methods easily. It shows the numbers clearly and quickly. You see how much something goes down in worth every year.

Use this tool to make smart money choices for your staff or business. Take a step today, try our calculator, and take control of your finances!

1. Will my personal payment information stay safe when using these calculators online?

If you’re on a secure site that uses things like PayPal, Stripe, or credit cards correctly, your payment information should be protected.

2. How do you use the calculator to determine depreciation?

Users input the asset’s value, and depreciation period, and choose a depreciation method (such as straight-line or declining balance). The calculator then computes the depreciation schedule, showing annual depreciation amounts and the remaining asset value.

3. What’s the significance of comparing different depreciation methods?

Comparing methods helps in making informed financial decisions. It allows users to assess how various depreciation approaches impact an asset’s value, enabling them to choose the most suitable method based on their financial goals and the nature of the asset.

4. Can the calculator handle various assets with different lifespans and values?

Yes, the calculator is designed to accommodate different assets by allowing users to input the asset’s value and expected life and choose from various depreciation methods. It generates schedules that reflect how each method affects depreciation for the specified asset.

Related Calculators: