Plan for your financial future with ease using the Annuity Calculator. It’s a simple tool that helps you estimate regular payouts over time, providing clarity for better decision-making. Take control of your financial planning today.

RESULTS

Are you trying to figure out how much money you’ll have in retirement from your annuity? Planning your financial future can be tricky, especially when it comes to understanding complex products like annuities.

Don’t worry, we’ve got something to help make sense of the numbers.

Annuities are a popular choice for securing steady income during retirement, but knowing exactly what you’re signing up for can sometimes feel overwhelming. That’s where our powerful annuity calculator steps in.

It simplifies the process and gives clear insights into what your investment could look like down the line. Our post will guide you through using this tool effectively so that planning for retirement feels less daunting and more doable.

Ready to get started? Let’s take control of your financial future!

What Is An Annuity?

An annuity is a financial product tailor-made to secure consistent income streams, typically utilized for retirement planning. Essentially, it’s an agreement where one makes a lump-sum payment or series of payments in exchange for regular disbursements beginning either immediately or at a future date.

Definition And Purpose

An annuity is a deal you make with an insurance company. You give them money now, and they promise to pay you back in smaller amounts over time. This can help you have money when you retire or can no longer work.

Some people use annuities to get steady payments for the rest of their lives.

Different kinds of annuities fit what you need. With some, you start getting money right away; these are called immediate annuities. Others, known as deferred annuities, begin paying later on.

Many folks like annuities because they help manage taxes on retirement savings and offer a way to turn saved-up cash into regular income after quitting their jobs.

Types Of Annuities

Annuities come in different types to meet various financial needs. Each kind serves a unique purpose for investing or planning for the future.

- Fixed Annuity: You get a guaranteed interest rate and regular payments. Insurance companies promise you’ll earn this steady rate, making it less risky.

- Variable Annuity: Your payouts change based on how well your chosen investments do. It’s like having mutual funds but wrapped up in an annuity contract.

- Indexed Annuity: Your returns are tied to a market index, like the S&P 500. You might earn more if the stock market does well, but there’s usually a limit to how high your earnings can go.

- Immediate Annuity: This one starts paying you soon after you put in your money. It’s good for people who need income right away, like retirees.

- Deferred Annuity: With this, you wait for payments to start. Money grows during the accumulation phase before you take it out.

- Variable and Fixed Annuities Hybrid (Equity-indexed): These offer a blend of variable and fixed features. You get a guaranteed return with the chance for higher gains linked to a stock index.

Tax Implications

Now, let’s look at how annuities can affect your taxes. When you put money into an annuity, the cash you use has often already faced income taxes. So, the dollars you invest are tax-free later when you get them back.

But any profit that comes from a traditional or variable annuity gets taxed as regular income when you take it out.

If you own a Roth IRA and buy an annuity with it, things are different. Here, money grows tax-free because the cash going into your Roth has already been taxed. So if rules are followed correctly, both your investment and its growth come out with no extra income taxes needed.

Keep in mind some other points too. Annuities inside a qualified retirement plan follow special rules for required minimum distributions (RMDs). Also, taking large sums at once could bump up your overall tax bill for that year.

Lastly, leaving an annuity to heirs may create additional taxation issues they’ll need to handle.

Benefits Of Calculator

A calculator for annuities makes figuring out money easy. It helps you see how much cash you can get from an annuity over time. You can try different numbers to learn about the best options before talking to a financial advisor.

This tool also saves time and reduces mistakes that might happen when doing math by hand.

Using this calculator shows how taxes, interest rates, and fees could affect your money. If you put in all your details, like age and savings, it gives you exact answers fast. Plus, it helps people who have retirement plans or life insurance policies understand their future income better.

It’s a smart way to plan so you have enough money later on.

Features Of Our Calculator

Our annuity calculator is not just a simple tool; it offers several key features that help you understand your financial future better. Here’s what makes our calculator stand out:

- Easy-to-use Interface: The calculator has a clear layout, making it simple for anyone to use. You can quickly enter your information without hassle.

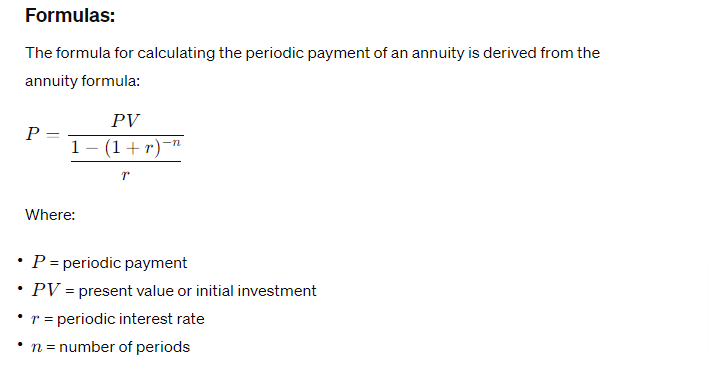

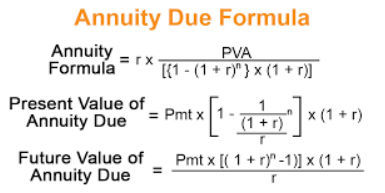

- Accurate Projections: It uses up-to-date formulas to give you precise figures on how much money you could receive from an annuity.

- Customization Options: You can adjust details like contribution amounts, frequencies, and interest rates to match your investment.

- Instant Results: As soon as you hit the calculate button, the tool immediately shows you the outcome so you can make decisions quickly.

- Detailed Breakdowns: The calculator provides breakdowns of payments over time, showing how much goes towards principal and interest.

- Tax Estimates: It gives an idea of potential tax implications related to traditional IRAs and qualified annuities, helping with long-term planning.

- Comparison Capabilities: You can compare different scenarios side-by-side to see how changing one factor affects your annuity’s growth.

- Savings Growth Visualization: Some graphs and charts make it easy to visualize how your savings could grow over time.

Factors Affecting Annuity Calculations

Understanding the factors that impact annuity calculations is crucial for an accurate projection of retirement income. These elements can significantly alter the outcome, influencing how much you receive periodically from your investment.

Interest Rates

Interest rates are a big deal when you calculate annuities. They help figure out how much your money can grow over time. If rates go up, your annuity might earn more money. But if they drop, you could see less growth.

That’s why it’s key to look at interest rates before you decide anything.

Your annuity payments change at different rates too. High interest can mean bigger checks in the future. On the other hand, low rates might make those payments smaller than expected.

Keep an eye on these changes because they affect both fixed and variable annuities, which means they impact your retirement plans.

Contributions And Withdrawals

Contributions to an annuity are the money you put in. Withdrawals are the money you take out.

- You can choose how much to contribute. Some people put in a lump sum, while others add money over time.

- Putting more money into your annuity can help it grow. This means you might get more income later.

- Taking money out of your annuity can come with fees. These are called surrender charges.

- If you withdraw too early, there might be extra costs. This often happens if funds are taken out before a certain age.

- Your annuity plan may have limits on contributions and withdrawals. Check these rules so you know what’s allowed.

- Taxes on money taken from an annuity depend on the type of account. Income tax may apply when you make withdrawals.

- Many annuities have a free withdrawal feature. This lets you take out some of your money without penalty each year.

- Regular withdrawals can provide a steady income. Think of it like getting paychecks after retirement.

- Making changes to contributions and withdrawals affects the final value. Use an annuity calculator to see how adjustments change your savings.

- The timing of contributions influences growth due to compounding of interest. Earlier investments have more time to earn interest.

Tax Rates

The money you put into annuities can grow without getting taxed right away. This is like how your money in retirement accounts such as 401(k)s or IRAs grows. But when you start taking money out, the government will tax it as income.

The rate depends on the total amount of money you make each year.

Your annuity may be part of a pension plan or other retirement account that has special rules for taxes. It’s important to know these rules so you aren’t surprised by a big tax bill later.

Keep in mind that if your annuity comes from after-tax dollars, only the earnings will be taxed when withdrawn.

Surrender Charges

Surrender charges are fees you might have to pay if you take money out of an annuity too early. They’re like a penalty for not sticking to the plan. The insurance company that gave you the annuity sets these costs.

They want to make sure they don’t lose money when people pull their funds out before the time agreed upon.

The cost can be high, especially in the first few years after you start your annuity. It gets smaller as more time goes by. Think of it as a way for the company to get back some of what they would’ve made if you’d left your money with them longer.

This is important when using an annuity calculator because it affects how much cash you’ll get if you decide to take out your investment early.

Other Calculators For Annuities

Explore a suite of specialized annuity calculators designed to help you navigate the complexities of retirement planning and ensure your financial security.

Income Annuity Estimator

An income annuity estimator can help you see how much money you might get each month from an annuity. Think of it like a tool that takes your saved money and shows what it could give as regular cash payouts during retirement.

You put in details about the cash you have, how long you want payments to last, and other personal information. Then, this calculator figures out your monthly income.

Using this kind of estimator is smart if you’re looking at different ways to turn savings into steady paychecks when you retire. It’s helpful because it shows changes in what you’ll get based on things like interest rates or how often you’ll receive money.

You don’t need to guess; the estimator works out the numbers for your situation with an annuity.

Fixed Annuity Calculator

A fixed annuity calculator helps you know how much money you can get from an annuity. You put in some numbers, like your start amount and the interest rate, and it shows what you’ll have later on.

It’s a good tool for people who want to make sure they have steady cash when they retire or any time after.

This calculator also lets you see how taxes might change what you get. You need to know this if looking at fixed-income options like pensions or CDs. The numbers it gives help plan for things like long-term care and life expectancy without guesswork.

Advanced Annuity Calculator

The advanced annuity calculator helps you figure out complex things about your money. If you have an annuity, this tool can show what the future value of your cash will be. It takes into account rates of return and how often you get payments.

This calculator is smart because it can also tell how charges like contingent deferred sales charges or administrative fees might change what you earn. You put in details like your interest rate, how much money you’re putting in, and taxes to see how these factors affect your payouts.

This type of calculator is perfect for people who know a bit more about finances. It’s good for financial advisory folks or real estate investors who want to plan long-term money goals.

The tool digs deep into the time value of money, showing how payments today could grow over years due to inflation or changes in the market. With help from this advanced tool, policyholders make better choices about annuities and feel sure that they understand their future income streams from investments like equity-indexed annuities or treasury bonds.

Lifetime Annuity Calculator

Moving from the advanced tools, a lifetime annuity calculator is made for those thinking about long-term income. This calculator helps you figure out how much money you might get each month during your retirement years.

It’s like having a crystal ball for your future finances. You just type in how much cash you have to start, your age, and some other details. Then it shows what you could be paid every year for the rest of your life.

This tool is super useful if you want a steady paycheck after you stop working. Some people use it to see if they can afford fun things when they retire or just to make sure they won’t run out of money later on.

With this calculator, planning feels less scary because it gives a clear picture of what to expect based on the choices you make now with pensions and savings.

So, whether you’re saving through an IRA, getting ready to enjoy pension plans, or looking at different insurance carriers, this nifty gadget takes into account stuff like cost-of-living adjustments and tax rates.

Think of it as your guide in making smart moves for a cozy financial blanket that lasts all through retirement.

Present Value Of Annuity Calculator

The present value of the annuity calculator helps you see how much a stream of payments is worth right now. It uses the idea of discounting to reduce future money to its current value.

This is useful if you’re trying to compare an annuity with other investment options like stocks, bonds, or certificates of deposit. You need to know your interest rate and payment amounts for the tool to work.

This calculator also makes it simple to figure out if taking a lump sum today beats waiting for future payments from things like life insurance policies or pensions. By punching in a few numbers, you can quickly learn which choice may be best for your financial situation.

- Annuity Payment Table:

| Period | Balance at the Beginning of Period ($) | Interest Earned ($) | Payment ($) | Balance at End of Period ($) |

|---|---|---|---|---|

| 1 | $10,000 | $100 | $500 | $9,600 |

| 2 | $9,600 | $96 | $500 | $9,196 |

| 3 | $9,196 | $91.96 | $500 | $8,787.96 |

| … | … | … | … | … |

| n | … | … | … | … |

This table demonstrates how the balance changes over time with interest earned and periodic payments.

It’s important because the value of money changes over time due to inflation and changes in interest rates. Determine market capitalization easily using our Market Capitalization Calculator.

Step-by-step Guide On How Calculator Works

Dive into our intuitive step-by-step guide to effortlessly navigate the annuity calculator, ensuring you confidently evaluate your financial future. Read on to master the tool that simplifies complex annuity calculations.

- Enter your initial investment amount into the annuity calculator.

- Input the final value from your annuity contract or statement.

- Specify your withdrawal plan, including start date, frequency, and additional cash needs.

- Add any increment amount to observe its impact on annuity growth.

- Click “Calculate” to quickly see the potential annuity payout.

- Review the result, indicating the depreciation period, for informed financial decisions.

Example

Imagine you have a life insurance policy that acts like an annuity. You want to know how much money you will get each year after you retire. You use our calculator and put in your numbers: the amount of money you have now, how much more you’ll add before retiring, and any fees or charges from the policy.

For example, if your current savings are $50,000, your planned yearly contributions are $5,000 for 10 years, with an annualized return rate of 5% and administrative charges of $100 per year.

You press calculate to see how this will work out over time.

Now picture someone else with a different kind of annuity—perhaps they’re getting payments from a defined-benefit pension plan or an equity-indexed annuity. They also enter their details into the calculator: starting balance, expected growth rate (yield), regular deposits or withdrawals they make (contributions), and when they think taxes might be due on this money (taxable event).

Let’s say their initial investment is $100,000 with no extra deposits or withdrawals and an anticipated yield of 4%. After filling in all these factors correctly and hitting the calculate button, they’ll learn how these elements affect their future income from the annuity. You can also simplify your financial calculations with our Triple Discount Calculator.

Scenario 1: Life Insurance Policy acting as an Annuity

- Initial Savings: $50,000

- Planned Yearly Contributions: $5,000 for 10 years

- Annualized Return Rate: 5%

- Administrative Charges: $100 per year

| Year | Beginning Balance ($) | Contributions ($) | Interest Earned ($) | Administrative Charges ($) | Ending Balance ($) |

|---|---|---|---|---|---|

| 1 | $50,000 | $5,000 | $2,750 | $100 | $57,650 |

| 2 | $57,650 | $5,000 | $3,282.50 | $100 | $65,832.50 |

| 3 | $65,832.50 | $5,000 | $3,741.63 | $100 | $74,474.13 |

| … | … | … | … | … | … |

| 10 | $141,745.23 | $5,000 | $7,087.26 | $100 | $153,732.49 |

Scenario 2: Defined-benefit pension Plan or Equity-Indexed Annuity

- Initial Investment: $100,000

- No extra deposits or withdrawals

- Anticipated Yield: 4%

| Year | Beginning Balance ($) | Contributions/Withdrawals ($) | Interest Earned ($) | Ending Balance ($) |

|---|---|---|---|---|

| 1 | $100,000 | $0 | $4,000 | $104,000 |

| 2 | $104,000 | $0 | $4,160 | $108,160 |

| 3 | $108,160 | $0 | $4,326.40 | $112,486.40 |

| … | … | … | … | … |

These tables provide a year-by-year breakdown of the balances and transactions for the two scenarios, allowing individuals to see how their investments grow over time and how factors such as contributions, interest earned, and charges impact their future income from the annuity.

You now know a lot about annuities. Annuity calculators help you see your money’s future. They make planning simple and quick. Do you feel ready to use one? Remember, this tool can change how you handle savings or retirement plans.

Start using the annuity calculator and take control of your financial future today!

Tables Related to Annuity Calculation

| Year | Annuity Payment | Interest Rate | Future Value |

|---|---|---|---|

| 1 | $10,000 | 5% | $10,500 |

| 2 | $10,000 | 5% | $11,025 |

| 3 | $10,000 | 5% | $11,576.25 |

| 4 | $10,000 | 5% | $12,155.06 |

| 5 | $10,000 | 5% | $12,762.82 |

Present Value vs. Interest Rate:

| Interest Rate | Present Value (for $10,000 Future Value, 10 years) |

|---|---|

| 1% | $8,952.38 |

| 2% | $8,243.24 |

| 3% | $7,612.26 |

| 4% | $7,059.89 |

| 5% | $6,575.24 |

FAQs

1. Can I use an annuity calculator for a joint annuity or pension?

Yes, you can use it to see what you’d get from a joint annuity or defined-benefit pension plan.

2. Will the annuity calculator tell me if my payments are taxed?

The tool will show you your payment amounts, but check with the Internal Revenue Service or AARP.org for details on how your annuity might be taxed.

3. Is it safe to use my credit card on an online annuity calculator?

You don’t need a credit card to use these calculators and make sure any site is FDIC-insured if sharing financial details.

4. Does an annuity calculator deal with mortgages and endowment policies too?

While some calculators focus just on retirement plans, others might help understand options like cash surrender value in endowment policies and how long it takes to pay off mortgages.

5. What are the crucial factors that an annuity calculator takes into account?

Annuity calculators consider factors such as interest rates, contributions, withdrawals, tax rates, surrender charges, and the timing of contributions and withdrawals. These factors significantly influence the projected income from an annuity.

6. How accurate are the projections made by an annuity calculator?

Annuity calculators use up-to-date formulas and user-provided inputs to generate projections. While they offer valuable estimations, the accuracy is dependent on the accuracy of the inputs provided by the user and market fluctuations that might impact returns.

Related Calculators: