Our Inflation Calculator is a simple and efficient tool to calculate the impact of inflation on your finances. By inputting the required data, you can quickly determine the real value of your money over time.

RESULTS

Are you wondering how much your money from the past is worth today? Inflation slowly chips away at the value of a dollar over time. This guide will introduce you to an inflation calculator that can help you understand the true impact on your finances. Keep reading to discover what those old dollars are worth now!

Definition Of Inflation

Inflation is when prices go up and the value of money goes down. You need more money to buy the same things you could before. It happens over time, so something that cost one dollar last year might cost more this year.

Prices rise for many reasons, like if there’s less of something but still lots of people want to buy it. Sometimes, too much money in the economy makes inflation happen because everyone has more to spend.

The government watches inflation with something called the Consumer Price Index (CPI). This helps them see how fast prices are changing.

Importance Of Calculating Inflation

Calculating inflation helps us understand how prices change over time. It shows if the money you have can buy less stuff than before. Think of it like a ruler measuring the value of your dollars.

Knowing about inflation is important for making smart decisions with your money. If you’re saving up to buy something big, or planning for retirement, you need to know how much more money you’ll need as time goes on.

An inflation calculator can be a handy tool here.

People who make things and sell them also watch inflation closely. They decide on prices and paychecks partly by looking at what’s happening with inflation. Inflation rates tell businesses how much they should charge customers so they don’t lose money but still keep buyers happy. Also, try our Term Deposit Calculator, a useful tool for estimating returns on your term deposits and planning your investments.

Understanding Inflation Rates

Understanding inflation rates is pivotal to grasping how the cost of living shifts over time and why your purchasing power changes, a concept that’s crucial whether you’re budgeting for next year or planning for retirement—keep reading to uncover what drives these economic currents.

Calculation of Inflation

To find out how much prices have gone up, we use inflation calculations. This tells us how much the cost of things has increased over time. We often use percentages to show this change in prices.

To calculate it ourselves, we take an item’s old price and compare it to its new price. Then, work out what percent increase it is from the old price to the new one.

The Consumer Price Index (CPI) helps us see inflation better. It compares what families pay for a bunch of different items now versus some previous period. Economists keep track of these changes every month or year and report how fast prices are going up or if they’re staying stable.

Using CPI information makes calculating inflation more accurate because it looks at all kinds of goods and services people buy regularly.

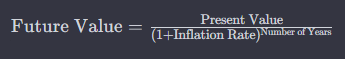

The formula for an inflation calculator can be expressed as follows:

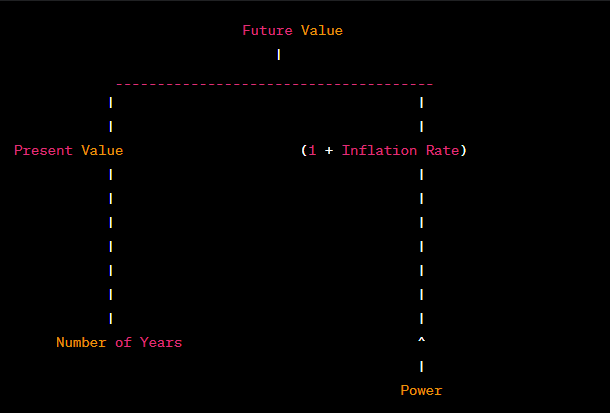

Here’s a graphical representation of the formula:

In this formula:

- “Present Value” is the initial amount of money.

- “Inflation Rate” is the rate at which prices increase over time.

- “Number of Years” is the time period over which inflation is considered.

- “Future Value” is the estimated value of money in the future, adjusted for inflation.

Factors That Influence Inflation

Prices go up when more people are wanting to buy things than what is available. This is called demand-pull inflation. It happens when everyone wants the same thing but there’s not enough for all.

Picture a hot new toy that every kid wants, but the store only has ten. Parents might pay more to make sure their child gets one.

Costs can also rise because making goods becomes more expensive. If the cost of oil shoots up, it costs more to move goods around and this pushes prices higher too — this type of inflation is known as cost-push inflation.

Money matters play a big role too. Central banks control how much money flows through an economy by setting interest rates and buying or selling government bonds. Sometimes if they let out too much money or keep interest rates very low, it can cause too many dollars chasing too few goods, pushing prices up.

Lastly, what people think will happen in the future can drive inflation now. If workers expect prices to rise, they ask for higher wages to keep up with costs; businesses then raise prices to pay for these wages and that cycle can boost inflation.

So far we’ve seen how various factors stir up inflation—let’s take a look at CPI next to understand better how we measure those price changes over time.

Historical Inflation Rates

Over the years, prices for goods and services have gone up. This rise in prices is called inflation. Inflation rates change from year to year and can be different in each country. The U.S. has seen times when inflation was very high.

For example, during the 1970s and early 1980s, inflation rates were much higher than they are today.

Knowing about past inflation helps us understand how money changes value over time. It tells us that what you could buy for one dollar many years ago costs more dollars today. Some periods had very low or even negative inflation, which means prices fell instead of rising.

| Year | Initial Amount ($) | Inflation Rate (%) | Final Amount ($) |

|---|---|---|---|

| 2000 | 1000 | 3 | 1030 |

| 2001 | 1030 | 2.5 | 1057.75 |

| 2002 | 1057.75 | 4 | 1099.71 |

| 2003 | 1099.71 | 3.8 | 1142.87 |

| 2004 | 1142.87 | 2.2 | 1168.15 |

| 2005 | 1168.15 | 3.5 | 1209.55 |

| 2006 | 1209.55 | 2.8 | 1243.81 |

| 2007 | 1243.81 | 4.1 | 1293.94 |

| 2008 | 1293.94 | 3.7 | 1342.61 |

| 2009 | 1342.61 | 1.5 | 1363.71 |

| 2010 | 1363.71 | 1.6 | 1385.36 |

| 2011 | 1385.36 | 3.2 | 1429.29 |

| 2012 | 1429.29 | 2.4 | 1463.73 |

| 2013 | 1463.73 | 1.6 | 1486.92 |

| 2014 | 1486.92 | 1.9 | 1515.15 |

| 2015 | 1515.15 | 0.1 | 1516.66 |

| 2016 | 1516.66 | 1.3 | 1536.66 |

| 2017 | 1536.66 | 2.1 | 1568.88 |

| 2018 | 1568.88 | 1.9 | 1599.34 |

| 2019 | 1599.34 | 1.8 | 1629.63 |

| 2020 | 1629.63 | 1.4 | 1652.01 |

| 2021 | 1652.01 | 1.7 | 1680.45 |

| 2022 | 1680.45 | 2.3 | 1718.72 |

| 2023 | 1718.72 | 2.5 | 1762.51 |

| 2024 | 1762.51 | 2.0 | 1799.96 |

Every period in history teaches us something important about how money works. Also, try our Inflation UK Calculator, specifically designed to calculate inflation rates for the UK, helping you make informed financial decisions.

What Is The CPI?

The Consumer Price Index, or CPI, serves as a critical barometer for gauging inflation by tracking changes in the cost of goods and services over time. This index plays a pivotal role in understanding economic health and guiding financial decisions both at the policy-making level and for individual consumers.

Overview Of The Consumer Price Index

The Consumer Price Index, or CPI, is a tool that tells us how prices change over time. It looks at the cost of things like food, housing, clothes, and other items that people buy for their everyday life.

The Bureau of Labor Statistics checks these prices every month to see if they go up or down. This helps figure out the inflation rate.

In the CPI, there are many different groups of items. They use a “market basket” idea to make sure they measure all kinds of goods and services regular people use. By tracking this basket each month, we can see which way costs are moving and understand how much more or less money we need to live our lives as time goes by.

How CPI Measures Inflation

CPI stands for Consumer Price Index. It is like a big shopping list that looks at the prices of many things people buy, like food, clothes, and toys. To measure inflation, experts check how the cost of this big shopping list changes over time.

If prices go up, it means inflation is happening.

Experts pick different items from places where city people shop to make sure the CPI shows what most people are paying more or less for. They keep track of these prices every month to see if it costs more or less money to buy the same things.

This helps us understand how much our money can buy as time goes by.

Categories Included In The CPI

The Consumer Price Index (CPI) looks at different things people buy to see how prices change over time. It includes costs for food, clothes, and houses. The CPI also checks prices for medical care, education, and entertainment.

Even things like haircuts and bus rides are part of it.

There’s a special basket that has all these items. Experts update this basket to make sure it shows what people spend money on today. They track urban consumers to get a good picture of price changes in the city areas where most people live.

This helps us know about inflation and how much it changes every year.

The Impact Of Inflation On Your Finances

Inflation quietly chips away at the purchasing power of your money, subtly shaping your financial landscape. Understanding this impact is vital for making informed decisions that safeguard your earnings and help maintain the lifestyle you’ve worked hard to achieve.

How Inflation Affects The Value Of Money

Inflation makes money worth less over time. This means you can buy fewer things with the same amount of money. For example, if inflation is 3% a year, what costs $100 now will cost $103 next year.

So your dollars don’t go as far.

If you have cash saved, inflation can make it lose value. It’s like putting water in a leaky bucket – slowly the level drops. To keep up, people look for ways to grow their savings faster than inflation rises.

This leads us to strategies for protecting against inflation.

Strategies For Protecting Against Inflation

To keep your money from losing value when prices go up, it’s smart to have a mix of investments. Stocks, real estate, and commodities like gold can all help. These kinds of assets often do better than cash when prices rise.

Another good idea is to buy bonds that adjust for inflation. These bonds change their payouts based on how much things cost, so you won’t lose out if prices shoot up.

You should also think about where you put your retirement savings. Putting money in different types of investments can protect it from inflation’s bite over time. It’s wise not to rely too much on one kind of investment but to spread your money out.

This way, some parts might grow even when others don’t because of high prices.

Now let’s look at why using an inflation calculator can help plan your money. Also, try our PVIFA Calculator, a helpful tool for calculating the present value interest factor of annuity, aiding in financial planning and investment analysis.

Benefits Of Using An Inflation Calculator

Harnessing the power of an inflation calculator provides users with a critical tool for financial clarity, allowing them to unravel the often complex impact of inflationary trends on their purchasing power.

Not only does it offer a precise gauge for evaluating how past, present, or future value changes affect finances, but it also serves as a practical aid in making informed decisions that can secure one’s economic stability over time.

Accurate Calculations

An inflation calculator helps you know how prices change over time. It uses real data to give you the correct numbers. If you have $100, and ten years later, you want to buy the same things, this tool can tell how much more money you will need.

This is called “adjusted for inflation.” It makes sure your money’s value is counted right with changing prices.

Using an inflation calculator lets you make smart plans with your money. Whether that’s saving for school or planning for when you retire, knowing about inflation helps a lot. You can see how costs go up every year and prepare better so that your future cash keeps its power to buy what you need or want.

Easy Comparison Of Buying Power Over Time

Having accurate inflation calculations is just the first step. With an inflation calculator, you can see how much your money could buy in the past compared to today. This helps you understand how prices change over time.

It’s like a time machine for your wallet!

You might have heard that a dollar back in the day could buy more than it does now; that’s because of inflation. Using an inflation calculator lets you put real numbers on that feeling.

You enter how much something costs then and find out what it would cost now. It makes planning easier, whether you’re saving for college or getting ready for retirement.

Planning For Retirement And Other Financial Goals

Saving money for the future can help you feel safe. As prices go up over time, what you can buy with your money may get smaller. You need to think about this when setting money aside for later years in life or other big plans like buying a house.

Using an inflation calculator shows you how much more cash you might need as time goes by.

Think ahead and use strategies that could keep your savings strong against rising costs. Putting money into different places like stocks, real estate, or bonds tied to inflation may protect your hard-earned dollars.

This way, even as things get more expensive, your savings could still let you enjoy a comfortable life after work is done or reach those dreams that cost a lot of money. Also, try our ERP Calculator, a practical tool for estimating your effective rental price, and assisting in decision-making related to renting or leasing.

Features Of Our Calculator

- Our inflation calculator comes packed with useful features. It gives you the power to see how the value of money changes over time because of inflation. This tool uses information like the Consumer Price Index (CPI) to make sure you get accurate results.

- You can check how much your money from the past would be worth today or find out what future dollars might be valued at.

- With our calculator, you can also learn about average inflation rates and see these numbers on a clear chart. This helps with understanding trends in consumer prices and planning for things like retirement or investing.

- The design is simple so anyone can use it without trouble, whether you’re just curious or need solid data for making big financial choices.

Step-By-Step Guide On How Calculator Works

Navigating the implications of inflation on personal finances can seem daunting, but our Inflation Calculator simplifies this process. This user-centric tool is designed to effortlessly provide insights into how inflation has affected your purchasing power over time with just a few clicks.

Let’s explore how you can leverage its features to make informed financial decisions.

- Enter the amount from the base year to establish the starting point for the inflation calculator.

- Choose the end year to determine how much the money would be worth due to inflation, considering major life events or financial decisions.

- Specify the country to account for different inflation rates, ensuring accurate results based on factors like food prices and housing costs.

- Press the “Calculate” button to let the inflation calculator analyze the data and show how inflation has affected the money’s value over time.

- Examine the results, including the ending value of the money, equivalent amount in past years, average inflation rate, and the total number of years analyzed. The detailed chart provides a comprehensive view of inflation’s impact on purchasing power over time.

Example

Let’s say you have $100 from 1990, and you want to know how much it is worth today because of inflation. You would enter $100 as the Amount Base Year. Then, you choose the current year for the End Year and pick your country, like the United States.

Hit the calculate button, and soon you see different numbers pop up.

You get an Ending Value which tells you what your old money is worth now. The Equivalent Amount shows what goods or services the same money could buy in both years. The Average Inflation Rate tells how much prices went up on average each year.

Total Years shows how long between your base year and end year—and there’s even a chart! This chart breaks down everything year by year so it’s easier to understand changes over time.

Now let’s move on to talk about the benefits of using an inflation calculator.

Now you know how inflation can change the worth of your money. An inflation calculator can help you see this over time. It is a smart tool for planning, whether for shopping or saving for retirement.

Remember, keeping an eye on inflation means you’re looking out for your future self. Your next steps could make a big difference in your money’s value, so give it a go and stay ahead!

FAQs

1. Why should I care about inflation?

Inflation affects how much stuff costs, which can change how much money you have for buying things like food and clothes. If prices go up but your pay does not, it might be harder to get what you need.

2. How does inflation impact people who are retired?

If prices rise because of inflation, retirees may find it tough since their fixed income from social security benefits or other savings may not stretch as far as before.

3. Can bonds protect me against inflation?

Yes, some bonds like Treasury Inflation-Protected Securities (TIPS) change their payments based on how much prices go up or down to help protect your money from losing value due to inflation.

4. Does higher inflation mean my income becomes less valuable?

When there’s high inflation, the value of your income can drop because each dollar buys fewer goods than before—like getting less at the store with the same amount of money.

5. What role do interest payments play during times of high inflation?

During high periods of hyperinflation, interest payments on loans like mortgages might increase since lenders want more to make up for the rising cost of living and risks that come with lending out money when prices are jumping up.

Related Calculators: