Easily calculate the Present Value Interest Factor of an Annuity (PVIFA) for accurate financial planning with our simple, efficient tool.

Results

Making sense of your financial future can be challenging, especially when planning for long-term investments or retirement. One key to unlocking this puzzle is understanding the present value of expected annuity payments, more commonly referred to as PVIFA.

This will guide you through what PVIFA is, how to calculate it with ease, and why it’s essential in financial decision-making. Keep reading for tools that may brighten your financial path!

What Is PVIFA?

The Present Value Interest Factor of Annuity (PVIFA) is an essential financial metric used to determine the present value of a series of annuity payments. By leveraging this figure, investors and finance professionals can gauge the cumulative impact that time and interest rates have on money received in the future, effectively bridging the gap between anticipated cash flows and today’s dollar value.

Definition And Purpose

PVIFA stands for Present Value Interest Factor of Annuity. It is a tool used in finance to figure out how much a series of cash flows, happening at regular intervals, is worth right now.

PVIFA helps you understand the value today of money you expect to get over a certain period at a fixed interest rate. People use this when they have things like car loans or mortgages and want to know their payments in today’s dollars.

The purpose of PVIFA is important for planning with money. If you’re saving up for retirement or looking at an investment that pays you back little by little over time, knowing the present value can help make smart choices.

By calculating the PVIFA, one can decide if it’s better to take a lump sum now or get those smaller payments in the future considering how much they are worth today.

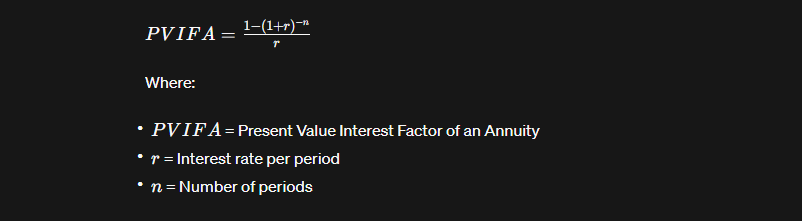

The Formula For Calculating PVIFA

To find out the PVIFA, you use a special math rule. It tells you how much a group of cash payments in the future is worth right now. Here’s how it works: you take 1 and then subtract it by (1 divided by (1 plus the interest rate per period) raised to the power of number of periods).

After that, divide this whole thing by the interest rate per period. This formula can help with money stuff like saving for retirement or figuring out loan payments.

Using this formula makes sure you’re smart with your money and plan well. You figure out how big checks written today would need to be to match those paid over many years. Next up, let’s learn about another key piece called the PVIFA table. Also, try our Term Deposit Calculator, a useful tool for estimating returns on your term deposits and planning your investments.

Difference Between PVIFA And FVIFA

PVIFA is short for the Present Value Interest Factor of an Annuity. It helps us understand how much money we’d get today from a series of future payments when we know the interest rate and number of periods.

It’s like knowing how much all your birthday money is worth right now.

FVIFA stands for the Future Value Interest Factor of an Annuity. This one tells us what our money will grow to in the future if we leave it alone to earn interest for a bunch of years.

Think about planting a tiny seed and seeing it grow into a big tree over time—that’s what FVIFA shows but with money!

So the main thing is PVIFA looks at cash coming to you right now, while FVIFA watches it grow bigger later on.

How To Calculate PVIFA

Calculating the Present Value Interest Factor of an Annuity (PVIFA) is a crucial step in assessing the profitability and attractiveness of fixed-income investments over time. By simplifying complex financial equations, understanding how to determine PVIFA enables investors to make informed decisions about their cash flows under various discount rates and periods.

Steps To Calculating PVIFA

Calculating PVIFA helps you understand the time value of money. It shows how much future payments are worth in today’s dollars.

- Find the interest rate for your investment or loan. This is usually a yearly rate.

- Decide how many periods, like years or months, you’ll get or pay money.

- Use the PVIFA formula: PVIFA = (1 – (1 + r)^-n) / r. Here “r” is your interest rate and “n” is the number of periods.

- Write down the interest rate as a decimal. For example, 5% becomes 0.05.

- Add 1 to your decimal interest rate.

- Take this new number and raise it to the negative power of your periods ( – n).

- Subtract that result from 1.

- Divide this by your decimal interest rate.

- Now you have your PVIFA value!

The rate as a decimal is 0.04.

Add 1 getting 1.04.

Example Of A Calculation

Let’s look at a simple PVIFA calculation. Say you’re planning to save $500 every year for 10 years, and the bank offers an interest rate of 5%. To find out how much money you’ll have in the end, use the PVIFA formula: \(PVIFA = \frac{1 – (1 + r)^{-n}}{r}\), where “r” is the interest rate and “n” is the number of periods.

Plug in your numbers: \(PVIFA = \frac{1 – (1 + 0.05)^{-10}}{0.05}\). After you do the math, you get a PVIFA of about 7.72.

Using this result, multiply it by your yearly $500 to see what those savings turn into over $500 times 7.72 equals $3860. This tells you that if you save $500 each year with a 5% interest rate for ten years, your total savings will become approximately $3860 before any more interest gets added on top during those ten years.

Understanding The PVIFA Table

The PVIFA table is a powerful tool for investors and financial professionals, offering an at-a-glance reference to determine the present value of an ordinary annuity based on various interest rates and periods.

Navigating this table can streamline the process of calculating future investments, making it an essential component in any thorough financial analysis.

| Periods (n) | Interest Rate (r) | PVIFA |

|---|---|---|

| 1 | r | 1/(1+r) |

| 2 | r | 1/(1+r)^2 |

| 3 | r | 1/(1+r)^3 |

| … | … | … |

| n | r | 1/(1+r)^n |

Explanation Of The Table And Its Use

A PVIFA table is a tool that makes it easy to see the value of an ordinary annuity. It shows many values for different interest rates and periods. You use the table to find where your chosen interest rate row meets with the column for how long you plan to invest or pay.

This point gives you a number, which is the PVIFA.

The number from the table tells you how much money today would equal a series of future payments. This helps when making choices about things like bonds, life insurance payouts, or saving plans.

It’s useful because it cuts down on time doing calculations and lets you compare options quickly without using financial calculators every time.

How To Read The Table

The PVIFA table is a tool that helps you see how much money you can get from an investment over time. Look across the top for the interest rate and down the side for the number of periods, like years or months, that you plan to invest.

Find where these two numbers meet on the table; this spot shows your PVIFA value.

To use it right, pick your interest rate and time first. Then find where they cross in the table. This number tells you what one dollar invested now will be worth at the end of those periods with that interest rate.

It’s handy for financial planning and comparing different investments quickly. Also, try our Inflation Calculator, understand the impact of inflation on your purchasing power over time, and plan your finances accordingly.

Tips For Using A PVIFA Calculator

To harness the full potential of a PVIFA calculator, familiarize yourself with its functionality and ensure that your inputs are accurate for precise results. Taking advantage of high-precision calculators can elevate your financial analysis, allowing you to make informed decisions regarding investment opportunities.

How To Use A High-Precision PVIFA Calculator

To use a high-precision PVIFA calculator, you first need to input the interest rate. This rate should be as exact as possible to ensure accuracy in your results. Next, type in how many times the investment will earn this interest – that’s your number of periods.

Press the calculate button and watch as the tool quickly works out your PVIFA value. Make sure all numbers are correct before hitting calculate, so you get reliable information for making smart money choices.

These calculators help a lot with financial management and investment analysis. They let you skip doing hard math by hand and give quick answers for comparing different options. You’ll see right away if an investment makes sense or not when looking at the present value of its future cash flows.

Use trusted resources online to find these calculators and make smarter decisions about where to put your money.

Links To Useful Resources

Finding the right tools online can make calculating PVIFA much easier. There are websites with high-precision calculators that let you put in numbers and get the result quickly. Also, some sites explain more about how annuities work and give tips for financial planning.

Look for resources made by trusted groups like universities or finance experts. They often have guides and tables that help you understand your calculations better.

You might also find video tutorials where someone shows you each step to find PVIFA values. These videos can be very helpful if you want to see someone else do it first.

How To Interpret The Results

Interpreting your PVIFA results is crucial for understanding the present value of a series of annuity payments, enabling informed decision-making in investment or retirement planning.

By grasping what this figure represents, investors can better strategize their cash inflows and gauge the attractiveness of different financial vehicles.

Proceeding with further reading will arm you with the knowledge to translate your PVIFA calculation into actionable insights within your financial portfolio.

Understanding What The PVIFA Calculation Means

The PVIFA calculation shows you how much money you’ll end up with after investing a set amount each period, like every year, at a steady interest rate. Think of it like planting seeds in your garden; the PVIFA tells you how big your plants could grow over time if you add the right amount of water regularly.

This value is key when planning your money goals because it helps to tell if an investment will give you the returns you’re hoping for.

If the PVIFA number is high, that’s good news—it means your regular investments will be worth a lot more in the future. Use this number to make smart choices about where to put your money so it can grow strong and big.

Now let’s look at what comes next: using a table that makes finding PVIFA values quick and easy!

How To Use The Value In Financial Planning

Knowing your PVIFA number helps you understand how much money you will have in the future from an annuity. An annuity is like a series of payments you get or make over time. If you are saving for retirement, use the PVIFA value to see if your plan will give you enough income later on.

It shows whether your savings and interest rates match up with your goals.

Use this number in financial planning to compare different investment options. A higher PVIFA means more cash over time from an annuity. So, if one investment has a bigger PVIFA than another, it might be better for long-term plans like retirement or saving for college.

By using this calculator, making decisions about where to put your money becomes clearer and smarter. Also, try our ERP Calculator, a practical tool for estimating your effective rental price, and assisting in decision-making related to renting or leasing.

Benefits Of Calculator

A PVIFA calculator makes figuring out the present value of an annuity formula easy. You don’t have to multiply numbers again and again or stress over making a mistake. With this tool, you get fast and precise answers.

This helps a lot when planning your investments or comparing different options.

Using a calculator saves time, so you can make quick decisions about money. It also helps keep your brain clear for big-picture thinking instead of getting lost in complex math problems.

Plus, it lowers the chances of error which is great news since even a small mistake with numbers can lead to big issues with money plans.

Step-By-Step Guide On How The PVIFA Calculator Works

Dive into the practical application of the PVIFA Calculator, where we’ll guide you through a simple user journey to effortlessly compute your own Present Value Interest Factor of Annuity.

Continue reading for a smooth, step-by-step experience, and embrace financial clarity with this powerful tool at your fingertips.

- Enter the interest rate as a percentage, ensuring it’s positive and without symbols like “%”.

- Input the number of periods, representing the duration of the investment or loan, accounting for the correct time frame (e.g., years or months).

- Press the “Calculate” button on the calculator after confirming all information for a quick result.

- Result the final number provided by the PVIFA calculator, indicating the present value of future payments, and use it to make informed financial decisions aligned with your goals.

Example

Let’s say someone is looking to invest money and wants to find out how much their cash will be worth after a certain time. They might use the PVIFA formula for this. Here’s an example: imagine they plan to put money into an investment vehicle that offers a 5% interest rate every year for 10 years.

They’ll type in ‘5%’ for the interest rate and ’10’ as the number of periods.

Once they hit calculate, they’ll see a number called the Calculated PVIFA. This number helps them understand how much all those future payments are worth right now. So if the calculator spits out 7.72, that means every dollar invested today will grow to be worth $7.72 over those 10 years at that 5% interest rate.

It’s like seeing into the financial future without having any fancy tools or powers!

Think about what you now know about PVIFA calculators. You learned how to define it, use a formula, and tell it apart from PVIFA. Remember that the steps are easy: you put in the rate and time, press calculate, and see your answer.

Using this tool can make money planning simpler for you. Now ask yourself how you might use this in your financial plans. Feel confident knowing these numbers help shape your future savings!

FAQs

1. Can I use the PVIFA Calculator to understand my investments better?

Yes, you can use this calculator to see how your investments will grow over time, which can help you make smarter choices with your money.

2. Is the PVIFA Calculator hard to use?

No, it’s not hard! You just put in some simple details like how often you get paid and for how long, and then it tells you what those payments are worth today.

3. Do professionals use the PVIFA Calculator too?

Yes, even people who work with money every day use this calculator because it gives quick answers about cash over time without doing tough math by hand.

4. How can I use a PVIFA calculator effectively?

To use a PVIFA calculator, input the interest rate and the number of periods accurately. Double-check your numbers before calculating to ensure precision. The calculator provides a quick PVIFA value, helping in investment analysis and decision-making.

5. What does the PVIFA calculation indicate?

The PVIFA calculation shows the worth of future payments in today’s dollars. A higher PVIFA suggests that regular investments made will yield a more significant sum in the future, aiding in financial planning and decision-making.

6. What benefits does a PVIFA calculator offer?

A PVIFA calculator saves time, provides precise results, and reduces the likelihood of errors in complex financial calculations. It assists in comparing investment options and facilitates clearer decision-making in financial management.

Related Calculators: