Explore the Term Deposit Calculator for accurate and simple financial planning. Make informed decisions by calculating potential returns with ease. Take control of your savings today.

RESULTS

| MATURITY | PRINCIPAL | MATURITY AMOUNT | Interest earned |

|---|---|---|---|

Many people wonder how much money they’ll make by putting cash in a term deposit. A surprising fact is that even small interest rate differences can lead to big changes in earnings over time. This guide offers easy-to-understand guidance on using a term deposit calculator to maximize your savings growth. Keep reading for smart saving strategies!

Explanation Of a Term Deposit Calculator

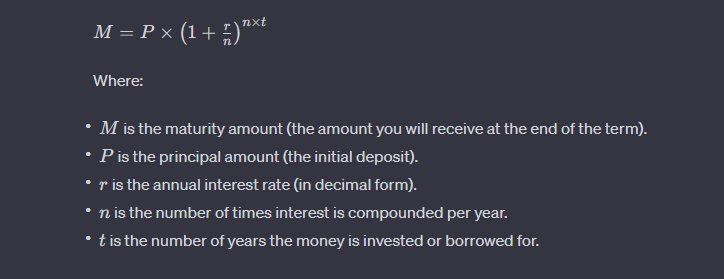

A term deposit calculator is a tool that helps you figure out how much money you’ll make by putting your cash into a fixed deposit. You put in details like how much money you want to save, the interest rate, and how long you’re going to save it.

Then the calculator does the math and shows you what your savings will grow to over time. It makes planning easy because it shows exactly how much interest you’ll earn without having to guess or do complex math yourself.

This handy gadget takes away the stress of financial decisions about term deposits at banks or credit unions. It uses compound interest formulas to show your money’s growth with simple or compound interest.

Use this calculator before heading to ICICI Bank, Westpac, or any other financial institution offering fixed deposits so you can choose the best option that fits your personal finance goals. Also, try our Inflation Calculator, understand the impact of inflation on your purchasing power over time, and plan your finances accordingly.

Benefits Of Using a Term Deposit Calculator

In today’s financial landscape, a Term Deposit Calculator emerges as an essential tool for investors seeking to maximize their earnings; it not only streamlines the process of forecasting interest accrual but also empowers users to make informed decisions by providing clear comparisons between various savings options.

With its precise computations, individuals can navigate the complexities of investment growth with confidence and ease.

Ability To Compare Different Term Deposits

A term deposit calculator helps you see how your money can grow with different banks or financial institutions. You can put in numbers like how much cash you want to save, the interest rates offered, and how long you plan to save it.

This tool shows you what each place will give back for your savings. It makes finding the best deal easy without having to guess.

By using the calculator, you get a clear picture of which term deposit could earn more money over time. Say one bank offers a higher interest rate but for a longer time, while another has a lower rate but for less time.

The calculator sorts this out and tells you which one puts more cash in your pocket at the end of the saving period. This smart tool takes away confusion and gives power back to savers wanting to make their money work harder.

Accurate Calculation Of Interest Earned

Knowing how much interest you earn from a term deposit helps plan your finances. A term deposit calculator does this job well. It tells you the exact amount of interest you will get at the end of the term.

You just put in how much money you are saving, the rate of interest, and for how long.

This tool takes out all the guesswork. You can trust it to give you a clear picture of what your savings will do over time. Whether it’s for a few months or several years, seeing those numbers makes it easy to decide if a term deposit is right for your money goals. Also, try our PVIFA Calculator, a helpful tool for calculating the present value interest factor of annuity, aiding in financial planning and investment analysis.

Factors to Consider When Choosing a Term Deposit

When exploring your options for a term deposit, it’s critical to weigh various elements that will influence the growth of your investment. From aligning interest rates with your financial goals to selecting an optimal term length and understanding potential penalties, these decisions require scrutiny to maximize returns without disrupting your liquidity needs.

Interest rates

Interest rates are very important when you think about term deposits. They tell you how much money your savings will earn over time. Banks and other places that offer term deposits set their rates, which can change often.

A higher rate means more money for you, but it also might come with stricter rules.

You should look closely at these rates before choosing where to put your money. The longer you agree to leave it there, the better the rate may be. Just ensure you won’t need this cash soon because taking it out early can cost a fee.

Next up is “Term length,” which plays another big part in planning your deposit.

Term length

The term length is how long your money stays in the deposit. It could be a few months or several years. A longer term usually gives you higher interest payments, meaning more money earned on your savings.

But think about how soon you might need to use that cash.

Choosing the right term is key. If you pick a short one, you can get your hands on your money sooner but might earn less interest. In the long term, it’s the opposite; you’ll have to wait longer to withdraw but can make more from interest rates.

After deciding on the term length, consider any early withdrawal penalties which we will discuss next.

Early Withdrawal Penalties

Choosing the right term length for your certificate of deposit is important. But it’s also key to think about what might happen if you take out your money early. Early withdrawal penalties can cost you a lot.

If you pull out your cash before the end date, the bank might make you pay a fee.

This fee often means giving back some of the interest you earned. The charge changes depending on where you put your money and how long before the end date you take it out. Let’s say you need to get to your savings fast because something unexpected comes up; it’s smart to know how much this will affect what you’ve earned so far. Also, try our ERP Calculator, a practical tool for estimating your effective rental price, and assisting in decision-making related to renting or leasing.

| Term Deposit Calculator | |

|---|---|

| Principal Amount | [Input field for the initial deposit amount] |

| Interest Rate (%) | [Input field for the annual interest rate] |

| Term Length | [Input field for the length of the term deposit in years] |

| Compounding Frequency | [Dropdown menu for selecting compounding frequency: annually, semi-annually, quarterly, monthly, etc.] |

| Total Interest Earned | [Calculation result showing the total interest earned over the term] |

| Final Amount | [Calculation result showing the total amount including principal and interest at the end of the term] |

Understanding CDs (Certificate of Deposits)

Understanding CDs, or Certificates of Deposit, is crucial for anyone looking to secure fixed-term investments with typically higher yields than a savings account; keep reading to see how they can fit into your personal finance strategy.

Definition and purpose

Certificates of deposit, or CDs, are a way for you to save money in a bank. You give the bank a sum of money to keep for you, called a “lump sum.” In return, they promise to pay back your lump sum with interest after some time passes.

This period can be several months or years; it is up to you when you start the CD. The purpose of CDs is that they often offer higher interest rates than regular savings accounts do.

So, by putting your money in a CD and leaving it there until the end comes (this is called “maturity”), you can earn more from your savings.

CDs are very safe because they’re usually protected by insurance from member FDIC if anything goes wrong with the bank. People who want to know exactly how much their savings will grow like using CDs.

They don’t have surprises like other investments might have. Next up let’s talk about how CD rates work and what factors affect them!

How CD Rates Work

CD rates show you how much money your Certificate of Deposit will make over time. You agree to keep your cash in the bank for a set number of months or years, and the bank agrees to pay you a certain rate of interest.

The longer you agree to leave your money in the CD, usually, the higher the interest rate you get.

Banks use these rates to attract customers and compete with other banks. Your rate won’t change even if new rates go up or down. This means that once you have put your money into a CD at a set rate, it stays at that same rate until it reaches its maturity date.

Now let’s look at what happens when you use a CD calculator with this information in hand.

Using a CD Calculator

Unravel the future potential of your investments by inputting simple details into our CD calculator, and stay tuned to demystify how this tool can streamline your financial planning journey.

Entering Deposit Amount, Term, And Rate

To use a term deposit calculator, you start by entering the amount of money you want to save. This is called the deposit amount. Next, decide how long you want to keep your money in the account; this is your term length, and it can be in months or years.

Lastly, type in the interest rate offered for this term deposit.

As soon as all your information goes into the calculator, it takes care of the math and shows you what you will earn with that interest rate over time. You’ll see how much money you get when your term ends – that’s called the maturity amount – which includes both your original deposit and the extra money from interest.

This helps you pick which term deposit might give you more cash back and fits best with your savings plan.

Understanding The Results

After you put in your deposit amount, term, and rate, the CD calculator shows how much money you will have at the end of your term. This is known as the maturity amount. You also see how much interest you’ve earned over time.

The results help you figure out how much your money grows with a term deposit or CD. This can make deciding where to put your savings easier.

You get a chart too. It breaks down your original investment (principal), total at maturity, and interest earned in an easy way to understand. The chart makes it simple to see how each part adds up over time.

If numbers go up more than expected, this might mean compound interest is working in your favor instead of just simple interest. Also, try our ABV Calculator, a handy tool for homebrewers and beer enthusiasts to calculate the alcohol by volume (ABV) of their brews accurately.

Glossary Of CD Terms

A CD, or Certificate of Deposit, is a savings tool that holds a fixed amount of money for a set time. Once the time is up, you get your original money plus interest back. The term “maturity” refers to when the CD ends and you can take your money.

A “fixed income” means the interest does not change while you keep your money in the CD. The “annual percentage yield” (APY) tells you how much money you will make in a year from the interest.

Knowing these terms helps when using an FD calculator to see how much extra cash you could earn. With this knowledge, picking out CDs becomes easier whether through banks or non-bank financial institutions like SoFi.

Always look for options with federally insured safety so your saved funds are protected up to certain limits even if something happens to the bank or institution holding them.

Features Of Our Calculator

Our term deposit calculator is packed with helpful features. It lets you easily figure out how much money you will make from your deposit over time. Punch in how much cash you’re setting aside, the yearly interest rate, and how long you plan to keep it in the bank.

You can trust it to do the math right every time.

The tool shows your end balance and total interest earned in a clear chart. This includes what part of the final amount is your original money and what part is extra from interest.

You’ll see everything at a glance without any fuss or confusion, making planning simple.

Next up, let’s walk through exactly how to use this smart calculator step-by-step.

Step-by-step Guide On How Our Calculator Works

Navigating the intricacies of term deposits becomes effortless with our user-friendly calculator. Grasp the full potential of your investment through a straightforward process that crystallizes future financial returns.

- Deposit Amount (RM): First, users put in how much money they want to save. This is the starting amount for the term deposit calculator. It’s important because it helps figure out how much interest you can earn over time.

- Annual Interest Rate (%): Users will need to know the annual interest rate for their term deposit. This is a percentage that shows how much money the bank or credit union will pay each year for using your deposited funds.

- Time Period (Months): Next, you choose how long your money will stay in the term deposit. This is called the time period and you put it in as months. If you pick a longer time frame, you might get more interest.

- ‘Calculate’ Button: After inputting the period, users are ready to see what their savings can grow into. They will click on the “calculate” button. This is like telling the calculator to do its math magic.

Result

Once you hit the calculate button, the term deposit calculator quickly shows how much money you’ll have at the end. This is your Maturity Amount. It also tells you exactly how much interest you’ve earned over time.

That’s the Interest paid at maturity part.

You get to see all this information in an easy chart too. The chart breaks down everything: how big your initial amount was (PRINCIPAL), what it grew to (MATURITY AMOUNT), and the extra money made from interest (Interest earned).

This makes understanding your investment simple!

Example

Let’s say you want to see how much money you can make from a term deposit. You find an online calculator for CDs (Certificate of Deposits). You have $5,000 that you can put away for 2 years.

The bank offers you an annual interest rate of 3%. So, you type in “$5,000” for the deposit amount. Next, you enter “3%” for the interest rate. Then, you add “24” for the number of months because that is how long 2 years is.

You click the calculate button and look at what it shows. The calculator tells you your money will grow to $5,306 by the end of those two years. It also breaks down that this growth includes $306 just from interest! This shows why using a CD calculator helps plan your savings.

A term deposit calculator is a smart tool to see how much money you can make. When you put in numbers, it shows you how your savings could grow. Think about using one before you lock away your cash.

Will it help you find the best place for your money? It sure makes comparing options easy and clear. So, take control of your savings today with confidence!

FAQs

1. How does the rate of return work with term deposits?

The rate of return is the money you make on top of what you put into your term deposit, including how often the bank pays out interest (compounding frequency).

2. Can I use a term deposit calculator for other things besides CDs?

Yes! You can also use it to see what kind of earnings you might get from high-yield savings accounts, money market accounts, and even bonds (securities).

3. When looking at mortgage rates or refinancing my home loan, should I look at term deposits too?

Sure! Comparing what you might earn on a term deposit with current mortgage rates can help decide if investing or paying off home loans sooner is better for your money.

4. Does online banking have tools like the term deposit calculator?

Yes, many online banking websites offer calculators that help compare different saving options like recurring deposits and rewards checking to see which has the best returns.

5. Is the use of a Term Deposit Calculator free?

Yes, Term Deposit Calculators are generally free to use on our website.

Related Calculators: