Our Enterprise Value Calculator is a tool that can help you calculate the enterprise value of a company. To use the calculator, you need to input the values for market capitalization, minority interest, preferred shares, the value of debt, and cash and cash equivalents.

RESULTS

The Enterprise Value Calculator simplifies this challenge by giving a more comprehensive measure of a company’s total worth than market capitalization alone.

We will guide you through financial valuations, bringing transparency to key calculations. With clear explanations of the economics behind company performance, you can evaluate investments with insight and assurance.

What is the Enterprise Value Calculator?

The Enterprise Value Calculator is a tool that helps anyone figure out what a company is really worth. It combines things like the price of all shares, how much debt the company has, and any cash it has on hand to give you a big picture number, this tells you what someone might pay if they wanted to buy the whole business.

This calculator gives people who invest in stocks or run businesses an important piece of information because it shows more than just what the stock market says a company is worth.

It lets them see past just share prices and get down to the true value behind those numbers. With this tool, there’s no need for guesswork because it turns complex financial facts into clear answers about a company’s actual value.

Now let’s explore how using this nifty calculator can make understanding enterprise value easier.

How the Enterprise Value Calculator Works

This tool meticulously integrates pivotal data from a company’s balance sheet, transforming complex figures into a distilled measure of its market worth and investment potential.

Input required for market capitalization, preferred shares, market value of debt, minority interest, and cash & cash equivalents

Calculating the enterprise value (EV) of a company is like figuring out how much it would cost to buy the whole business. The Enterprise Value Calculator helps you find this number. Here’s what you need to put into the calculator:

- Market capitalization: This is how much all the common stock of the company is worth on the stock market. To get this, multiply the current stock price by the total number of outstanding shares.

- Preferred Shares: These are special stocks that pay set dividends. Add up the value of all these preferred stocks because they are part of what you’d buy in a takeover.

- Market Value of Debt: Find out how much money the company owes. This includes long term debts, short term debts, and commercial papers. It’s important because a buyer would have to take on this debt.

- Minority Interest: Sometimes companies own only part of other companies. The minority interest is how much these parts are worth if not fully owned by your company.

- Cash & Cash Equivalents: This includes actual cash, money markets, and Treasury bills that can quickly turn into cash. Subtract these from what you’d pay since a buyer gets to keep this cash.

Enterprise value formula: EV = MARKET CAPITALIZATION + MARKET VALUE OF DEBT – CASH AND EQUIVALENT

Once you’ve gathered all the numbers for market capitalization, preferred shares, and other factors, it’s time to calculate enterprise value (EV). Think of EVs as a way to measure how much it would cost to buy every part of the company.

To find this number, add up the total value of all shares out there, which is market capitalization. Then include all the money the company owes or its debt, because if you buy the company, you take on that debt too.

But if the company has cash or anything easily turned into cash, like savings or short term investments, subtract those from your total. This gives you a clear picture of what someone might need to pay if they want to own the entire business.

This formula helps people see not just what a company looks like on paper but also how valuable it is when everything is added together—sort of like checking your piggy bank and adding in any money under your mattress while also paying off any money you owe your friend.

It shows investors more than just what one share costs; it shows them what they’d have to spend for everything if they wanted to take over. Unlock precision in your financial analysis with our powerful Margin Calculator.

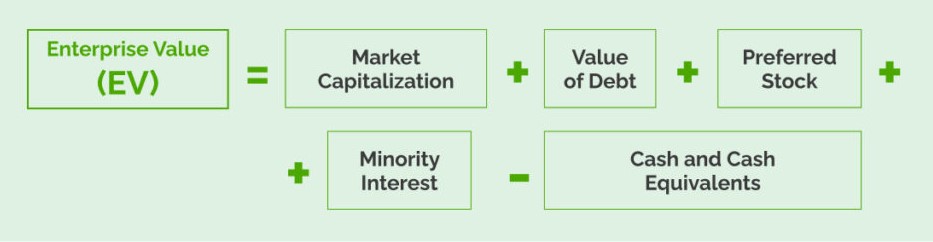

Extended formula, including common shares, preferred shares, market value of debt, minority interest, and cash and equivalents

To find a company’s full economic value, you can use an extended enterprise value (EV) formula. This powerful tool adds the value of common and preferred shares to the market value of debt.

Then, it includes minority interest, which is money owed to investors who don’t control the company. Cash and cash equivalents are subtracted from this total because they are assets that a buyer would get in a takeover.

Using this detailed method shows what a business could sell for in real life. It counts all parts of a company’s capital structure where they got their money to run the business.

Now let’s look at why using an EV calculator has big advantages for anyone interested in business worth.

Benefits of Using the Enterprise Value Calculator

Harnessing the Enterprise Value Calculator equips savvy investors with a comprehensive metric for assessing a company’s true market valuation, paving the way to informed and strategic investment decisions—discover how it can transform your financial analysis.

Determining the actual economic worth of a company

Finding out how much a company is really worth involves looking at the whole picture. You need to think about all the money it owes and owns, along with its shares. The Enterprise Value Calculator makes this easy.

It adds up the value of debt, interest, and shares, then subtracts the cash that doesn’t owe anything back.

Knowing a company’s true value is like having a key to understanding its place in the business world. It shows how strong a company stands on its own without any debt hanging over it.

This helps people decide if buying the company is a good choice or not. If you were to buy out all of a company’s business right now, this number would tell you what price tag to expect—minus what it has in liabilities and debts! Optimize your calculations with our advanced Percentage Calculator. Access this versatile tool and streamline your percentage related computations with precision.

Measuring the theoretical takeover price of a company’s business

To know how much it might cost to buy a whole company, people use the Enterprise Value (EV). This number includes more than just the price of all the shares. It also adds to the money owed by the company and any interests others have in parts of the business.

Then, it takes away any cash or things like cash that could pay off some debts quickly. The result is that someone might pay for everything if they want to take over.

This way of measuring can guide investors and companies looking at a merger or acquisition. It gives them a clearer picture of value beyond just sharing prices. For example, an EV of $12,400 shows that buying out this entire business would likely cost about that amount.

Now let’s see how you figure out this important number with an enterprise value calculator!

How to Use the Enterprise Value Calculator

Let this tool streamline your evaluation workflow, turning complex data into actionable insights with just a few clicks.

Step by step guide

Let’s talk about how to use the Enterprise Value Calculator. This tool is great for understanding how much a company is really worth.

- Gather your data. You’ll need numbers like market capitalization, the value of preferred shares, and debt. Don’t forget about any minor stakes in the company and cash on hand.

- Find the market capitalization value. This number shows you how much all common shares are worth at the current stock price.

- Add up any preferred shares. These are special stocks that pay dividends before common stocks get anything.

- Know your debt amount. Look at the financial statements to find out what the company owes; this includes bonds or loans.

- Consider minority interests if they exist. These are parts of smaller companies that the main company owns just a piece of, not the whole thing.

- Subtract cash and similar stuff; we’re talking about liquid assets that can quickly turn into money.

- Use the Enterprise Value formula: EV = MARKET CAPITALIZATION + MARKET VALUE OF DEBT, CASH, AND EQUIVALENTS.

Example

Let’s look at a real example to understand how to calculate enterprise value. Imagine a company that has a market capitalization of $10 billion, debt valued at $4 billion, and cash plus equivalents of $1.5 billion.

You take the market cap and add the total debt, which gives you $14 billion. Then you subtract the cash and equivalents from this sum to get an enterprise value of $12.5 billion.

This figure tells us what it might cost to buy all parts of the company, including its debts, without counting its cash on hand. People who want to invest in or maybe buy out a whole company use this number a lot because it shows more than just what the stock is worth—it includes important stuff like how much debt there is too.

Simplify your sales tax calculations with our user friendly Sales Tax Calculator. Click here to access this efficient tool and ensure accurate sales tax computations for your financial needs.

FAQS

1. Why is enterprise value considered more informative than market capitalization alone?

Market capitalization only reflects the market value of a company’s equity. Enterprise value includes debt, cash, and other factors, offering a more nuanced view of a company’s financial position.

2. Is there a standard enterprise value that companies should aim for?

There’s no one-size-fits-all standard for enterprise value. It varies by industry, company size, and financial goals. Comparisons with industry peers are often more meaningful.

3. Does an enterprise value calculator consider the cost of capital?

Yes, it does! It uses the weighted average cost of capital (WACC) or discount rate, which shows how much interest companies pay on their combined debts and equities.

4. Can you measure risk with this type of calculator during mergers and acquisitions (M&A)?

Yes! When doing M&A analysis or portfolio analysis, people look at the D/E ratio and other financial numbers to understand risks before they make deals.

5. How does the enterprise value impact investment decisions?

Investors use enterprise value to assess a company’s true value, compare investment opportunities, and understand the impact of a company’s capital structure on its overall worth.

Try our other calculators as well: