Our Margin Calculator is a user-friendly tool that allows you to calculate gross margin, net profit margin, and operating profit margin. Simply input the necessary data, such as costs and revenue, and the calculator will instantly provide you with the relevant margin information.

RESULTS

Understanding Profit Margin Calculation

Understanding how to calculate profit margins is essential for any business looking to analyze its financial performance and strategize for success. This core aspect of financial management provides vital insights into the profitability of operations, guiding decisions that can ultimately determine a company’s competitive edge and market position.

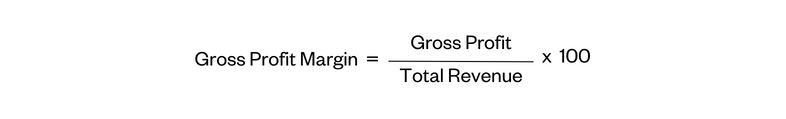

Gross Profit Margin

Gross profit margin tells you how well a company turns materials into profits. Think of it as the money left after paying to make the product, before other costs like salaries and rent come out.

It’s like checking how much gas is left in your car after a trip—it shows if you’re using fuel efficiently. To find this number, use the gross margin formula: Gross Margin = 100 * Profit/Revenue.

Knowing your gross profit margin helps you make smart choices for your business. If the number is high, you’re on track, but if it’s low, you may need to look at what’s costing you too much or not selling enough.

Just remember, this doesn’t cover all expenses, only the costs directly tied to making and shipping products.

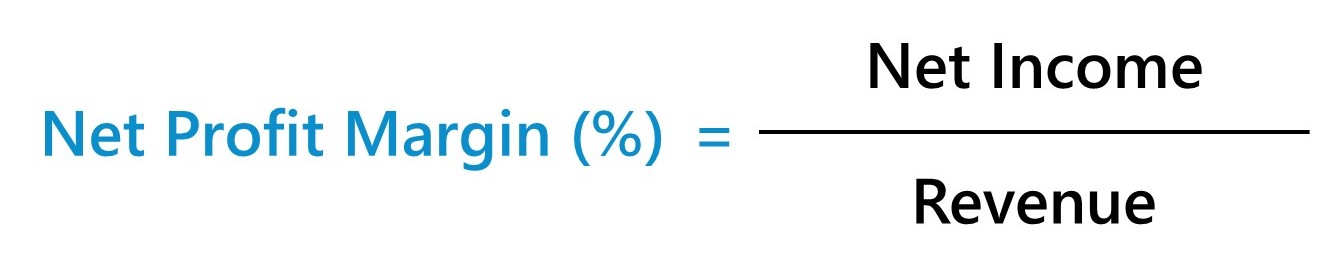

Net Profit Margin

Moving from gross profit margin, let’s focus on net profit margin. This is what tells us how much money a company really keeps after paying all its costs. Think of it as the true measure of a business’s success.

To find this number, you use revenue and subtract costs like the cost of goods sold (COGS), operating expenses, depreciation, and taxes.

The formula for net profit margin is pretty simple: take your total revenue, subtract all expenses, then divide that by the revenue and multiply by 100 to get a percentage. A higher percentage means the company does well at turning sales into actual profit.

Using a margin calculator can quickly show you this important number without making mistakes or wasting time trying to figure it out yourself. It helps keep an eye on your financial health and makes sure your business stays competitive in the market. Simplify your sales tax calculations with ease using our Sales Tax Calculator.

Operating Profit Margin

Operating profit margin tells how well a company makes money from its core business compared to its costs. Think of it as the money left after paying for things like workers, office supplies, and ads.

A healthy operating profit margin means the company is good at turning sales into profits before taxes and interest. To find this number, divide operating profit by revenue and multiply by 100.

This measure is key to knowing if a business can pay for all it needs while still earning enough cash. It includes every cost that has to do with running the day to day business. This gives you a clear picture of financial health without mixing in other stuff like loans or investments that aren’t about selling goods or services.

Keeping an eye on this margin helps leaders make smart choices to keep their companies strong and profitable over time.

Margin Calculator Features

A robust margin calculator emerges as an indispensable tool for businesses, offering a sophisticated analysis of profit metrics with user-friendly inputs. It unlocks the potential to transform raw data into actionable insights about profitability, equipping entrepreneurs with the precision needed to strategize and thrive financially.

Revenue and Sales Cost Input

Knowing how to input revenue and sales costs is key to using a profit margin calculator. These figures help you find important numbers like your gross margins.

- Start with your total sales revenue. This is the money you make from selling goods or services before any costs.

- Enter the cost of sales (COS). These are the direct costs tied to making the product you sell, such as materials and labor.

- Make sure to include all variables in the cost of sales. Things like shipping, factory overhead, and storage can add up.

- Don’t mix up different types of costs. Keep separate totals for production costs and other expenses like marketing or rent.

- Double-check your numbers. Errors here can lead to wrong calculations down the line.

Calculation of Profit Margin and Markup

Once you have your revenue and the cost of sales figures ready, it’s time to calculate profit margin and markup. These calculations help you understand how much money you make from your products and how much you should charge to earn a profit.

- First, find out your gross profit by subtracting the cost of sales from your revenue. This tells you the total money made before any other expenses are paid.

- Use the gross profit to calculate the gross margin percentage. Do this by dividing the gross profit by the revenue and then multiplying by 100.

- To get a net profit, take away all other expenses from your gross profit. These might include things like rent, salaries, and taxes.

- Figure out the net profit margin by dividing net profit by revenue and multiplying that number by 100. This shows what portion of each dollar earned is actual profit.

- Understand the markup as well. Markup is different from margin. The markup shows how much more you’re charging compared to the cost of sales.

- Calculate the markup percentage with this formula: (selling price – cost) / cost x 100. This gives you a percentage increase over your item’s cost that results in the selling price.

- Keep track of these percentages over time to see trends in your business finances.

- Compare your margins and markups with industry standards to check if you’re pricing products right and staying competitive.

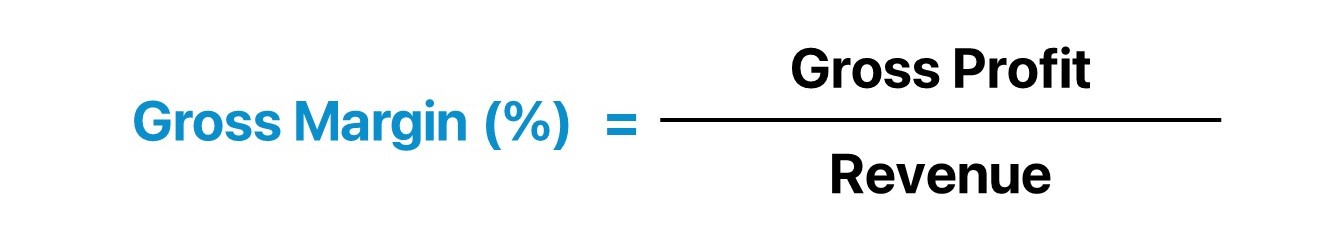

Gross Margin Calculation

Gross margin helps to find out how well a company makes and sells products. To find it, take your profits and divide them by your sales revenues, then multiply by 100. This turns it into a percentage that shows the part of sales that turns into profit after you cover the cost to make or buy your products.

It’s like checking how much gas is left in the tank after a long trip.

Measuring gross margins guides business leaders to better see if their company makes money efficiently. It’s key for tracking progress without mixing in other costs like paying workers or keeping the lights on at the office.

Next, let’s see why knowing about margins is so important for any business. Plan your financial future with our handy ANC Calculator, helping you determine accumulated net capital.

Importance of Margin Calculation

Knowing how to calculate margins is important for businesses. It gives them the information they need to make smart decisions that boost profits and help them stay competitive in their markets.

Financial Health Assessment

A margin calculator is a key tool to check how well your business is doing. It tells you if you’re making enough money from what you sell after paying all the costs, like making the product, paying workers, and keeping the lights on.

This information lets you take charge of your company’s financial health. You can see where you need to cut costs or where you might invest more to grow.

Knowing your net profit margin is like having a clear picture of your business’s success. It tells whether or not your company keeps enough money after all expenses are paid. A good net profit margin means your business can face tough times and still make it through.

It also shows investors and banks that your company handles its money wisely. If this number is strong, it could mean better chances for loans with lower interest rates when needed. Make informed financial decisions using our PrePost Calculator to compare values before and after an event.

Business Profitability Analysis

Knowing how well a business is doing can be tough, but it’s really important. This is where profit margins come into play. They help owners figure out if they are making enough money from their sales after paying all the costs.

Using a margin calculator makes this job easier and faster. You don’t have to use hard math or know complex formulas because the tool does it for you.

Looking at profit margins tells you about the health of your business in clear numbers. It takes into account revenue and what it costs to make those sales happen. With these numbers, you can compare yourself to other businesses and see where you stand in the market.

A good profit margin might mean more money in your pocket or that your company could borrow money more easily for big projects or new products. Transform your financial analysis with the precision of our advanced Enterprise Value Calculator.

How to Use the Margin Calculator

Grasp the simplicity of boosting your business’s financial efficiency by following our step-by-step guide, leading you toward a clear understanding of your profit landscape and empowering strategic decision-making that drives growth.

Step-by-Step Guide

Using a margin calculator helps you understand your business’s profits quickly and easily. Here is how to use one:

- Determine whether you want to calculate gross margin, net profit margin, or operating profit margin.

- Locate the field labeled “Cost” in the calculator. Enter the cost of the product or service. This represents the expenses associated with producing or providing the item.

- Find the field labeled “Revenue” in the calculator. Enter the total revenue generated from the sale of the product or service.

- Choose the specific margin you want to calculate: gross margin, net profit margin, or operating profit margin.

- Look for the “Calculate” button on the calculator interface. Click on the “Calculate” button to initiate the computation.

- Examine the results provided by the calculator based on your chosen margin type.

- If you calculate gross margin, you’ll get “margin, profit, and markup.”

- If you calculate the net profit margin, you’ll receive only “margin.”

- If you calculate the operating profit margin, the result will be “operating margin.”

FAQs

1. What does a margin calculator do?

A margin calculator helps you find out your business’s net income or loss by looking at the difference between how much money comes in and goes out.

2. How is using a margin calculator important for my credit score?

Using a margin calculator can show you if your bills, like credit card payments, are too high compared to what you make, which affects your credit score.

3. Does the margin vs. markup feature of the tool help with setting prices?

Yes! It will guide you on how much more to charge than what something costs so that your business model works and meets your goals.

4. Is knowing about cash flow statements necessary when calculating margins?

Knowing about cash flow is key because it shows if there’s enough money coming in from things like sales or loans to keep running smoothly.

Related Calculators: