Make financial decisions with ease using our EBITDA Calculator. It’s a straightforward tool for assessing your business’s operational performance.

RESULTS

Measuring a company’s financial performance can be complex, leaving many business owners in search of clarity. An EBITDA calculator simplifies this analysis by focusing on operational profitability before the influence of accounting and financial deductions.

Keep reading to learn more about EBITDA and how it can help you understand your business’s financial performance.

Understanding EBITDA

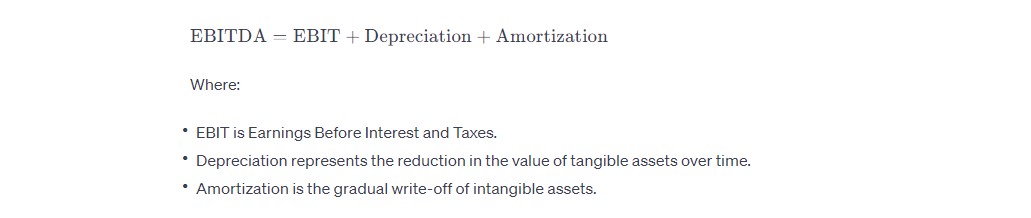

The EBITDA formula is: EBIT + Depreciation + Amortization

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. To calculate it, start with EBIT, which is your operating profit. This number comes from your income statement after you take away costs like salaries and rent from the money you make selling goods or services.

Then add back two things: depreciation and amortization. These are ways to spread out the cost of long-term assets over time.

Imagine you bought a big machine for your factory that will last ten years. Each year, part of its cost counts as an expense called depreciation. It’s similar if you paid for something like a patent; spreading this cost is called amortization.

Adding these back to EBIT gives us EBITDA! It shows how much money a company makes from doing what it does best without worrying about loans, tax rules, or how it spreads out certain costs over time.

EBITDA (Simple) = EBIT + Depreciation + Amortization

Let’s break it down to make it even easier. EBIT stands for earnings before interest and taxes. This is what a company earns before it pays any interest on debts or taxes to the government.

Now, add two more things: depreciation and amortization. Depreciation is when stuff a company owns, like machines or buildings, loses value over time. Amortization is similar, but for things you can’t touch, like patents or copyrights.

You take the money made before paying interest and taxes (EBIT), then add back the value lost in stuff you own (depreciation) and the value lost in things you can’t touch (amortization).

This total gives you EBITDA, a simple number that tells how much cash a business might have made from its operations without those extra costs getting in the way. It helps people see how well a business is doing to make money from what it does best.

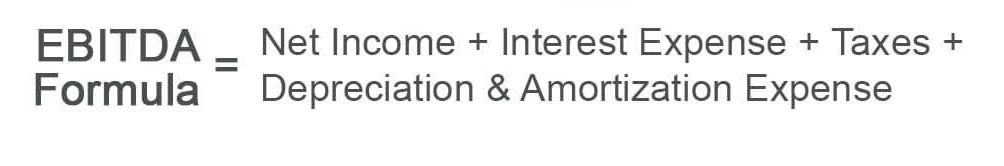

EBITDA (Extended) = Net Profit + Taxes + Interest + Depreciation + Amortization

To understand a company’s money-making power, look at EBITDA (extended). This number shows you what the business earns before it pays for things like loans and old equipment. It mixes net profit with other costs such as taxes, interest, and wear on tools and machines.

Having these details helps people see how well a business is doing.

Think of EBITDA (extended) as a tool to get the real story of a company’s earnings. It adds back important costs that can hide how profitable the operations really are. With this number in hand, investors can tell which businesses make enough money to cover their big expenses and still come out ahead. Simplify your inventory tracking with our FIFO and LIFO Calculator. Try it today for precision in cost management!

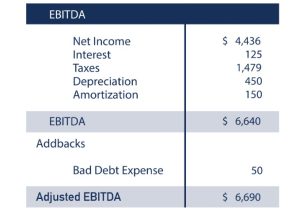

Example of EBITDA Calculations

Here’s an example of EBITDA calculation using the formula EBITDA = Operating Income + Depreciation + Amortization:

- Operating Profit: $116 million

- Depreciation and Amortization: $570 million

EBITDA = Operating Profit + Depreciation + Amortization

EBITDA = $116 million + $570 million

EBITDA = $686 million, The EBITDA for this example is $686 million

Importance of EBITDA Calculation

Understanding the importance of EBITDA calculation is fundamental for stakeholders who aim to gauge a company’s financial health and operating performance beyond just its net income.

It serves as a critical financial metric, enabling investors and analysts to compare profitability across different companies or industries without distortions from tax rates, financing decisions, or accounting practices—all crucial aspects when making informed investment decisions or conducting thorough business valuations. Supercharge your savings strategy now! Utilize our innovative Discount Calculator to make informed financial decisions.

Comparing profitability between companies and industries

EBITDA is like a tool that helps us see how well companies make money before they pay for some big costs. Think of it as comparing runners without worrying about the shoes they wear or the paths they take.

It’s fair because it looks at just their running skills, not other things that could change the race.

This is handy when we put different types of businesses side by side to see which one does better at making profits. Some businesses have lots of things they own, like big machines or buildings, and these can cost a lot over time.

EBITDA lets us forget those costs for a bit, so we can just look at the cash they bring in from selling stuff or providing services. This way, even if one company has more expensive stuff than another, we can still tell who’s really better at earning more money with what they’ve got.

Assessing the financial success or worth of a company

Just like comparing profitability helps us understand a company’s performance, assessing financial success or worth digs deeper. It gives investors a clear picture of how well a company uses its resources to make money.

Looking at EBITDA is key for this deep dive. This measure strips out costs like taxes and interest, so it really focuses on the business itself.

A strong EBITDA can show that a company has good control over its operating expenses and is making lots of revenue. When you see high margins, you know that after paying for things needed in the day-to-day running of the business, there’s still plenty of money left.

That’s why investors often look at EBITDA to decide if a company is healthy and worth putting their money into. Optimize your business valuation strategy with precision – explore the capabilities of our advanced Enterprise Value Calculator.

EBITDA Margin Calculation

Understanding the EBITDA margin is pivotal in dissecting a company’s operational efficiency and profitability. It serves as an insightful indicator by revealing how much operating cash is generated for each dollar of revenue, equipping investors and managers with a clear metric to gauge business performance beyond mere income figures.

EBITDA Margin = EBITDA / Total Revenue

To know how well a company uses its money, look at the EBITDA margin. This tells us what part of sales is left after paying for things to run the business but before paying interest, taxes, and costs for using equipment or buildings for a long time.

A higher EBITDA margin usually means that the company is doing better at keeping costs down and making more money from every dollar of sales.

Think of it like a score that shows how efficient a company’s team is at scoring points without losing any to other teams. It helps people decide which companies are strong and can handle their bills easily.

Managers and investors also use this number to compare companies in different industries to see which ones might be better to invest in or work with.

The significance of EBITDA margin in analyzing business performance

Knowing how to figure out the EBITDA margin helps us see a company’s strength in making money. A good EBITDA margin means a business can pay its operating costs and still earn more. It shows investors how much cash profit a company makes from its revenue.

A high EBITDA margin usually means the company is doing well. It tells us that the company earns enough money to handle things like paying interest, taxes, and buying new equipment without hurting their cash flow too much.

This number is key for comparing different companies or industries to see which ones are really good at turning sales into profits. Streamline your financial transactions effortlessly! Access our dynamic Sales Tax Calculator for quick and accurate calculations.

How to Use the EBITDA Calculator

EBITDA calculator simplifies complex calculations by automatically aggregating key financial inputs, enabling you to accurately measure business performance with just a few clicks.

Steps to calculate EBITDA using the calculator

- Enter your total revenue, representing the money earned from selling goods or services, before deducting any costs.

- Input all costs of goods sold (COGS), including expenses directly tied to producing your product or delivering your service.

- Add the values of amortization and depreciation.

- Click the calculate button to let the calculator process the information.

- Review the EBITDA margin value provided. This key figure reveals the company’s cash profit before accounting for taxes, interest payments, and some other costs.

Utilize this tool for objective financial comparisons between companies, avoiding the impact of varying tax rules or cost-covering strategies.

FAQs

1. Is EBITDA the same as net income?

No, EBITDA and net income differ. EBITDA focuses on operational earnings, excluding interest, taxes, depreciation, and amortization, while net income considers all expenses, including taxes and interest.

2. Are there any limitations to using EBITDA?

Yes, EBITDA has limitations and should not be the sole metric for assessing a company’s financial health. It doesn’t account for changes in working capital, capital expenditures, or non-cash expenses.

3. How frequently should I calculate EBITDA for my business?

The frequency depends on your business needs. It’s common to calculate EBITDA quarterly or annually for financial reporting and analysis purposes.

4. Is EBITDA the same as cash flow?

No, EBITDA does not represent cash flow. While EBITDA provides an operational profit figure, cash flow includes changes in working capital and capital expenditures. Understanding both metrics is crucial for a comprehensive financial analysis.

5. How can EBITDA be used in conjunction with other financial metrics?

EBITDA is often used alongside metrics like net income, cash flow, and various ratios to form a comprehensive financial analysis. Utilizing a combination of these metrics offers a more holistic view of a company’s financial health.

6. Can the EBITDA Calculator be applied to assess the financial health of a startup?

Yes, the EBITDA Calculator can be adapted for startups, but it’s crucial to consider the unique financial dynamics of early-stage companies. Startups may have different financial structures, and consulting with financial experts is advisable for accurate analysis.

Related Calculators: