Understanding a company’s profitability is crucial, but conducting the complex math behind it can be daunting. Earnings Per Share (EPS) is a direct measure of an organization’s profit allocated to its common stock. With our easy-to-use calculator, you can find the earnings per share in no time.

RESULTS

Our detailed guide provides every kind of information that you need to know about using our calculator. Read on to find out more!

What Is Earnings Per Share (EPS)?

Earnings Per Share (EPS) represents a company’s profitability, distilled to reflect the portion of earnings attributable to each share of common stock. As a fundamental metric in financial analysis, EPS serves as an indicator of a company’s financial health and efficiency in generating profits for its shareholders.

Definition And Calculation

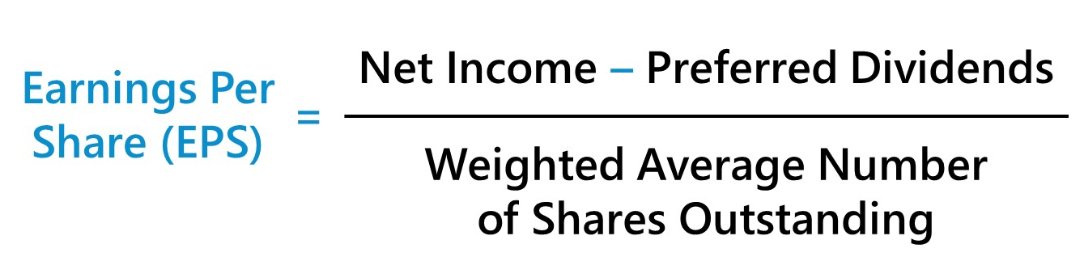

Earnings Per Share (EPS) serves as a key indicator of a company’s profitability, distilled down to what it means for individual common stock ownership. To calculate EPS, subtract the dividends paid on preferred stock from net income and divide that figure by the average number of outstanding common shares.

This formula crystallizes the return on investment shareholders can expect.

Imagine Company ABC with a net income of $3,120,000,000 and owing $200,000,000 in dividends to preferred stockholders. With 333,400,000 common shares out in the market, we do quick math: ($3,120,000,000 – $200,000-00) / 333-400-00 = an EPS of $8.76 per share.

This simple yet powerful calculation strips complex financials down to an understandable profit-per-share value – crucial for making informed decisions about your investments’ performance or growth rate potential.

Importance Of EPS

Now that you’ve grasped the mechanics of calculating EPS, let’s delve into its significance. EPS serves as a beacon, illuminating a company’s profitability and providing invaluable insights into financial performance.

Investors and analysts rely heavily on this metric to assess stock valuation and corporate health. Picture it as the pulse check for investors: high EPS usually signals strong company performance, making the shares more attractive.

Tracking EPS trends offers a window into growth potential, guiding investment analysis toward smarter decisions. It isn’t just about current profits; it’s also a predictor of future gains.

Understanding how earnings per share reflect on return on investment gives finance professionals an edge in crafting strategies that enrich market value. The savvy use of an Earnings Per Share Calculator can unlock these insights effortlessly, enabling users to identify prime investment opportunities based on solid data rather than guesswork.

How To Use The Earnings Per Share Calculator

Using our Earnings Per Share Calculator is very easy, all you have to do is just enter the required information.

Inputting Net Income

Starting with net income is a crucial step in calculating Earnings Per Share (EPS). You’ll be dealing directly with your company’s profitability, as this figure represents the total profits after expenses and taxes, but before paying out dividends on preferred stock.

Accurate input of this data is fundamental to assessing financial performance and ensuring shareholders have a clear picture of corporate finance health.

To enter the net income correctly into an EPS calculator, use the profit amount from your most recent financial statements. This number should reflect all operations over a specified period and must not include any dividends earmarked for holders of preferred stock.

Your precision here sets the stage for reliable investment analysis and helps gauge your firm’s ability to generate earnings relative to its share price – a critical indicator for potential investors scrutinizing financial ratios.

Inputting Dividends On Preferred Stock

After noting the net income, it’s time to address dividends on preferred stock within your Earnings Per Share calculations. These payments take precedence over any distributions to common stockholders and must be deducted from the company’s net income before computing EPS.

This subtraction ensures that the calculated EPS reflects available earnings for common shareholders only.

To accurately report your company’s financial position and shareholder equity, you’ll need to account for the dividend impact of this asset class in your EPS formula. It is crucial because these dividends can significantly alter a firm’s reported profitability and influence investment decisions based on EPS values.

As such, ensure meticulous entry of preferred dividends as they play a key role in assessing a company’s true economic health.

Inputting Average Outstanding Common Shares

Having calculated the impact of dividends on preferred stock, your next step in using the Earnings Per Share Calculator involves determining the average number of outstanding common shares.

This figure represents the shares issued by the company that are held by investors, excluding those bought back or held by the company itself. It’s crucial because it directly influences EPS; a higher number of outstanding shares can dilute earnings, while fewer can amplify them.

To get an accurate read on EPS, find your company’s average outstanding common shares for the period you’re analyzing. Companies usually report this data quarterly or annually in their financial statements.

Take these numbers to compute an annual average if necessary. For example, if halfway through the year more stocks are released or repurchased, adjust your calculations accordingly to ensure precision in assessing stock valuation and corporate finance health based on net income and profitability per share basis.

For more information on a company’s profits, you can try out our Return On Asset Calculator.

FAQs

Question: Why Is Calculating Earnings Per Share Important?

Calculating earnings per share is important because it shows how profitable a company is and can help you decide if you want to invest in it.

Question: What Information Do I Need To Use An Earnings Per Share Calculator?

To use an Earnings Per Share Calculator, you need the company’s total profits and the number of shares they have.

Question: How Often Should I Calculate A Company’s Earnings Per Share?

You should calculate a company’s earnings per share whenever they report new financial results to see if there are any changes in their profitability.