WACC stands for Weighted Average Cost Of Capital. It represents the average cost of a company’s various sources of capital. The proportion of each source in the overall capital structure is also taken into account. The sources of capital mostly include debt and equity.

RESULTS

This guide will unravel the intricacies of WACC, equipping readers with the knowledge to employ a WACC calculator effectively for financial analysis. So let’s dive into the world of corporate finance where we make sense of numbers that shape strategic decisions.

What Is WACC and How Is It Calculated?

Understanding WACC, or the Weighted Average Cost of Capital, is fundamental for finance professionals as it serves as a critical tool in measuring the average cost a company pays for its financing sources.

To calculate WACC, one must integrate the costs of equity and debt capital—each weighted according to its proportion in the overall capital structure—factoring in corporate tax implications to determine this essential rate that influences strategic investment decisions.

The WACC (Weighted Average Cost of Capital) Formula

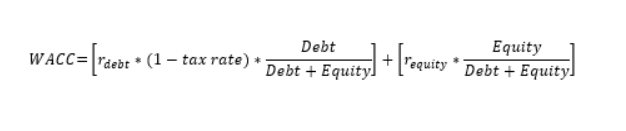

The WACC formula tells us the average rate a company must pay to finance its assets. It’s like a combo meal deal that blends what it costs to get money from shareholders and lenders. Here is the formula:

The Terminology Is As Follows:

- Debt= market value of debt

- Equity= market value of equity

- rdebt= cost of debt

- requity= cost of equity

This mix gives finance leaders an important tool. Think of it as a financial compass helping steer big decisions like whether investing in new projects will be worth it or how much investors should get paid for their risk-taking party trick with hard-earned dollars at stake.

Calculate carefully though; using market value instead of book value when figuring out E and D makes your answer even sharper – accuracy counts here!

Factors Involved In The calculation

Calculating the Weighted Average Cost of Capital (WACC) involves several factors. These components reflect both the debt and equity that finance a company’s assets.

- Cost of Debt: This is the interest a company pays on its debts, such as loans or bonds. It should be calculated as an after-tax cost because interest expenses are tax-deductible. Use the formula “Interest Expense × (1 – Tax Rate)” to find it.

- Cost of Equity: This represents the return investors expect for investing in the company’s shares. Calculating it often involves using models like the Capital Asset Pricing Model (CAPM), which considers risk-free rate, beta (a measure of market risk), and risk premium.

- Market Values: For accurate WACC calculations, use market values, not book values, for debt and equity weights. Historical market value weights are better than expected future values or book values for this purpose.

- Tax Rate: Consider your company’s marginal tax rate since it affects the after-tax cost of debt by creating a tax shield.

- Capital Structure: The ratio of debt to equity in your firm influences WACC; more debt may lower WACC due to the tax shield but increases financial risk.

- Dividend Policy and Investment Policy: These policies play a role because they affect expectations about future cash flows and growth rates which influence the cost of equity.

What’s The Importance of WACC?

Understanding the Weighted Average Cost of Capital (WACC) is a cornerstone for any finance professional—its strategic significance lies in its role as a vital benchmark. It guides decision-making by quantifying the average rate that an organization must pay to finance its assets, balancing risk and reward, and serving as a fundamental tool for both internal project evaluation and external investment analysis.

1. Determining The Cost Of Capital

Figuring out the cost of capital is like setting a price for borrowing or using money. For a business, it’s key to know this so they can decide what projects or moves are worth their cash.

This price, known as WACC, mixes together what it costs to get money from shares (equity) and from loans (debt). It also takes off some money for tax breaks on interest payments.

Knowing this number helps leaders make smart choices about where to put their company’s money. They want to pick projects that will earn more than this rate because it means the business will grow and succeed.

If WACC is low, it’s cheaper for a firm to start new things which is great news!

2. Evaluating Investment Opportunities

Knowing your WACC helps you make smart choices about which investments to pick. It’s like a hurdle that projects need to jump over for you to consider them worthwhile. With this number, you figure out the present value of future money your project might bring in using discounted cash flow (DCF) analysis.

If an investment’s return beats the WACC, it means the project is likely a good move.

Using WACC turns complex decisions into clearer ones by providing a rate to use in net present value (NPV) calculations. This way, managers and students can see if an investment will give more money back than what it costs or if it falls short.

You want investments that earn back their cost and then some; these are winners that can bring value to a company or portfolio.

3. Use In Discounted Cash Flow (DCF) Valuation

A WACC serves a critical role in financial modeling, especially within a DCF valuation. Investors and managers use it as the discount rate to convert future cash flows into present value.

This helps them figure out what an investment is worth today based on its expected returns down the road. Think about measuring how much you might earn from a business or project against the risk you’re taking by investing your money there.

Using WACC lets finance professionals make sure they’re not paying too much for investments. It guides them when looking at new projects or companies to invest in. For example, if your firm has a lower WACC, funding projects become less expensive which is great news for growing businesses.

Analysts put this number to work every day to assess investment opportunities and decide where funds should go to maximize returns while keeping risks in check.

Benefits of Using a WACC Calculator

Here are some of the benefits that you can enjoy by using a WACC Calculator.

1. Quick and Accurate Calculations

Using a WACC calculator makes figuring out the weighted average cost of capital simple and fast. You type in your numbers for how much money you have, what your debts are, and the taxes you pay.

The calculator does all the tricky math in seconds. This way, you can trust that your results are right without spending lots of time on them.

Handy features let you change your figures easily to see different outcomes. Say your business takes on more debt or tax rates go up; update these in the tool and get new calculations quickly.

This helps managers make smart choices about money without delay. It’s like having a math genius who knows all about funding at your service!

2. Easily Adjustable Inputs For Different Scenarios

A WACC calculator lets you tweak numbers to see how different situations change your costs. You might change the cost of equity or debt, the total money put in by shareholders or borrowed, and what you owe for taxes.

This helps because companies often need to know how much it costs them to use different kinds of money like loans or investor funds.

Let’s say interest rates go down because the central bank decides so, or corporate taxes go up. You can quickly adjust these in the calculator to find out your new WACC. This tool is super useful for checking if a project is worth the risk based on how much it will cost you in capital.

It also helps when figuring out if the returns from an investment are enough compared to what people who gave you money expect back.

3. Consistency In Calculations

Having easily adjustable inputs is one part; making sure those numbers stay correct over time is just as key. To keep things accurate, it’s vital to use the same methods and values in calculating WACC.

This way you know that the final number, your discount rate for evaluating investments or figuring out cash flow value, is something you can trust.

Every time you figure out WACC, using market value weights gives a more real picture than book values. The historical market data helps too because it makes your calculations steady and dependable.

This means when finance students or managers look at different companies or projects, they compare them with a reliable rate. Plus, if you always calculate WACC this way, everyone who puts money into the company knows what to expect about their returns which should be around 15% on average.

Limitations of WACC

Using WACC is great but it still has its own set of limitations. Here are some limitations that you need to know about!

1. Exclusion Of Financial Risk

WACC is a tool that helps us know how much it costs for a company to get money. But one thing it misses is financial risk. This means the WACC doesn’t show how things like changing interest rates or credit ratings can affect the cost of getting money for a company.

When we use WACC, we assume everything stays the same over time. We don’t think about how economic ups and downs can change what investors want for their investments. Because of this, sometimes WACC might not give the full picture, especially when there’s a lot of uncertainty in markets or economies.

It can lead to making decisions with only part of the story told by numbers.

2. Assumptions About The Cost Of Capital And Inputs

Calculating the cost of capital involves some guesses. We think that things like interest rates, how much debt a company has, and taxes won’t change much. But they can move up or down because of new rules or shifts in the economy.

Also, we guess how risky an investment is when figuring out what return investors want. If we get these things wrong, our WACC number might not be right either.

It’s key to use market value rather than book value for working out WACC. This makes sure we’re looking at current prices instead of old ones from financial records. And it’s best to look at past market values over time for the most solid numbers to use in our calculations.

These steps help managers make better choices about where to spend money and decide what projects or companies are worth investing in.

FAQs

Question: What Is A WACC Calculator?

A WACC calculator helps find the Weighted Average Cost of Capital, which shows what it costs a company to finance assets with debt and equity.

Question: Why Do Companies Use The WACC?

Companies use the WACC to see how much interest they must pay on their capital, like loans or stocks, to keep investors happy.

Question: What Kinds Of Financing Are Part Of Calculating WACC?

Debt financing from bonds and loans, preferred stock dividends, and equity financing from selling shares all help figure out a company’s WACC.

Question: How Does WACC Affect Decisions In A Business?

Businesses look at the WACC as a hurdle rate for making choices about investing money or thinking about mergers or startup capital needs.

Question: Can I Use The Risk-Free Rate In My Calculations With The WACC Calculator?

Yes! You can include rates like those from treasury bonds as risk-free when you calculate your company’s cost of using different types of funding.

Question: Do Taxes Play Any Role In Figuring Out The Weighted Average Cost Of Capital (WACC)?

Absolutely! Tax deductions lower costs on things like debt interest, so they’re important when working out your business’s overall expenses for borrowing money.

Conclusion

WACC is used in financial modeling and valuation to discount cash flows and determine the present value of a company’s future earnings or cash flows. It represents the hurdle rate that a company needs to achieve to generate value for its investors. After the calculations, if you get a higher WACC then it means that the risk is higher, especially with the company’s investments and operations.

Remember, if WACC goes down, it’s good because projects cost less to start. Now go ahead and try using our WACC calculator!